OUTLINE -- LESSONS 3a, 3b, 3c

Understanding Individual Markets: Demand and Supply

Parts of this lecture can be found at:

http://www.harpercollege.edu/mhealy/eco211/lectures/microch3-17.htm

|

Additional Web Pages for this lecture:

|

|

The type of news articles that pertain to this

chapter:

|

I. Introduction: Prices and the 5Es

- From what we know about the 5

Es of economics, why are we studying PRICES?

- Prices are important to achieve which of the Es?

- In a Capitalist Economic System (Lesson

2a), Prices are the result of the interaction of Supply

and Demand

- Preview:

- If the price of pizza increase, what happens to the

demand for pizza?

- If the price of plywood increases what happens to the

supply of plywood?

II. Demand

A. Definition

1. a schedule

2. various quantities

3. willing and able

4. various prices

5. given time period

6. ceteris paribus

7. demand is NOT how much we buy

B. Demand Schedule and Curve [sdtabblk.gif]

[sdpoint.gif]

[sdline.gif]

C. Law of Demand

1. there is an inverse relationship between price

and quantity demanded

2. why?

a. common sense

b. diminishing marginal utility

c. income effect

d. substitution effect

D. Market Demand

1. definition

2. graphically

E. Determinants of Demand (VODKA)

1. the price of the

product

2. the non-price determinants of

demand

V. Two Kinds of Changes Involving Demand

A. Change in Quantity Demanded

1. caused ONLY by a change in the PRICE of the

product

2. a movement ALONG a SINGLE demand curve

B. Change in Demand

1. shifting the demand curve / a new demand

schedule

a. an increase in demand

b. a decrease in demand

2. caused by a CHANGE in the non-price determinants of

demand

a. Pe -- expected price

b. Pog -- price of other goods

1) substitute goods

2) complementary goods

3) independent goods

c. I -- income

1) normal goods

2) inferior goods

d. N -- number of POTENTIAL consumers

1) population change

2) expanded marketing area

3) new competitor

(changes individual demand curve but NOT market demand

curve)

4) change in eligible consumers (i.e. drinking age)

e. T -- tastes and preferences

III. Supply

A. Definition

1. a schedule

2. various quantities

3. willing and able

4. various prices

5. given time period

6. ceteris paribus

7. supply is NOT the quantity available for sale

B. Supply Schedule and Curve sssupply.gif

sdspnt.gif

sdsline.gif

C. Law of Supply

1. there is a direct relationship between price and

quantity supplied

2. why?

a. common sense

b. increasing costs because some resources are fixed

c. increasing costs because not all resources are

identical

D. Market Supply

E. Determinants of Supply

1. the price of the product

2. the non-price determinants of supply

VI. Two Kinds of Changes Involving

Supply

A. Change in Quantity Supplied schgqs.gif

1. caused ONLY by a change in the PRICE of the

product

2. a movement ALONG a SINGLE supply curve

B. Change in Supply slineinc.gif

1. shifting the supply curve / a new supply

schedule

a. an increase in supply

b. a decrease in supply

2. caused by a CHANGE in the non-price determinants of

supply

a. Pe -- expected price

b. Pog -- price of other goods ALSO PRODUCED BY THE FIRM

c. Pres -- price of resources

d. T --technology

e. T --taxes and subsidies

f. N -- number of sellers

3c - Market Equilibrium and

Efficiency

|

IV. Market Equilibrium -- Equilibrium Price

and Quantity

A. Market Equilibrium

1. define equilibrium

2. find market equilibrium sdequil.gif

B. Market Disequilibrium

1. surpluses

2. shortages

What causes prices to

change?

|

VII. Changes in Demand AND

Supply

A. Case 1: D changes and supply stays the same

dinc.gif

B. Case 2: S changes and demand stays the same sinc.gif

C. Case 3: D and S both change

1. S increases, D decreases

2. S decreases, D increases SDdisd.gif

3. S increases, D increases SDdisi.gif

4. S decreases, D decreases

VIII. Examples:

- Chapter Appendix: Additional Examples of Supply

and Demand

- I. Changes in Supply and Demand

A. Lettuce

B. Exchange Rates

- 1. One of the largest foreign exchange

markets is the euro-dollar market.

2. The price of a euro is expressed in

dollars and is determined by demand and supply of

euros.

3. U.S. firms require euros to buy goods from

European countries and this is reflected by the

demand for euros.

4. When European countries buy goods from the

U.S. they must convert euros to dollars thereby

creating the supply of euros.

5. Increased popularity of European goods in

the U.S. increases the demand for euros, causing

equilibrium price to increase and the dollar

depreciates while the euro

appreciates.

C.Pink Salmon

- 1. This is an example of simultaneous

changes in both supply and demand.

2. An increase in supply occurs because of

more efficient fishing boats, the development of

fish farms, and new entrants to the

industry.

3. There is a decrease in demand because of

changes in consumer preference, and an increase in

income shows pink salmon to be an inferior

good.

4. Both changes put downward pressure on the

price of pink salmon. Because we know that the

increase in supply of pink salmon exceeded the

decrease in demand, we can also determine that the

quantity purchased increased.

D. Gasoline

- 1. U.S. gas prices have rapidly increased

over the past few years.

2. Middle East politics and military

conflicts (both real and anticipated) have

disrupted supply, tending to drive gas prices

up.

3. Increased popularity of SUVs and other

low-gas-mileage vehicles has increased the demand

for gas, also tending to drive the price

up.

4. While theoretically the affect on quantity

is indeterminate, in reality the quantity purchased

has increased, suggesting that the increase in

demand exceeded the decrease in

supply.

E. Sushi

- 1.Despite fast-growing popularity of sushi

bars in the United States, prices have remained

relatively constant.

2.The increase in demand can be attributed to

an increased taste for sushi.

3.The opening of sushi bars in response to

expected and realized demand has increased the

supply of sushi, helping to keep the price

stable.

II. Preset Prices

|

IX. The Market System and Efficiency

See: YELLOW PAGES: The supply and demand

model and allocative efficiency

A. Introduction: The Market System and Efficiency

A. Equilibrium price and allocative efficiency

B. Two models

a. MB = MC (MSB = MSC)

b. Consumer and producer surplus

B. The MB=MC model

1. WHAT WE GET:

a. Goal of businesses: Maximize Profits

b. Therefore, they will produce where:

- the Market Equilibrium quantity

- the quantity where Qs=Qd

- the is "what we get"

- Graphically:

c. Assumptions: pure capitalism

2. WHAT WE WANT: ALLOCATIVE EFFICIENCY

a. Review :

(1) Allocative Efficiency

definition - using our limited resources

to produce:

- The quantity of goods and services that

maximizes society's satisfaction

- using resources to produce more CDs that

people want and fewer cassette tapes that they

don't want

- no shortages and no surpluses

(2) Benefit-Cost Analysis

definition -

the selection of ALL possible

alternatives where the marginal benefits are

greater than the marginal cost

select all where: MB >

MC

up to where: MB = MC

but never where: MB < MC

3. Allocative Efficiency is achieved where:

a. MSB=MSC

1) define Marginal Social Benefits (MSB)

2) define Marginal Social Costs (MSC)

3) therefore if society gets

all quantities

where: MSB > MSC

up to where: MSB = MSC

but never where: MSB < MSC

this will be the

quantity where society's Satisfaction will be

maximized or the allocatively efficient

quantity

b. Graphically:

4. THEREFORE:

a. Businesses will produce the profit maximizing

or market equilibrium quantity - the quantity where

Qd=Qs

b. Society wants the allocatively efficient quantity -

the quantity where MSB=MSC

c. WHAT WE GET = WHAT WE WANT if:

1) Market Demand = Marginal Social Benefits

(D=MSB)

a) law of diminishing marginal utility

b) assuming no positive externalities (no spillover

benefits) D=MSB

2) Market Supply = Marginal Social Costs

(S=MSC)

a) law of increasing costs

b) assuming no negative externalities (no spillover

costs) S=MSC

5. Competitive Markets and Allocative Efficiency

(MSB=MSC)

a. if there are no negative externalities (no

spillover costs,) then S = MSC,

b. if there are no positive externalities (no

spillover benefits), then D = MSB,

c. Graphically:

d. Then: WHAT WE GET = WHAT WE WANT and market

economies achieve allocative efficiency

|

In a market economy with no spillover

benefits and no spillover costs:

the profit maximizing

or market equilibrium quantity

(what we get)

WILL BE THE SAME AS

the allocative efficient

quantity

(what we want)

|

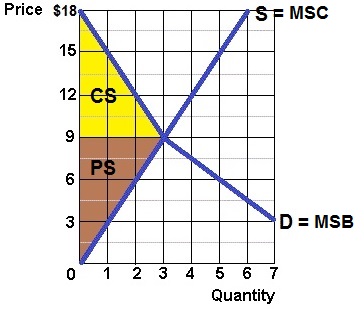

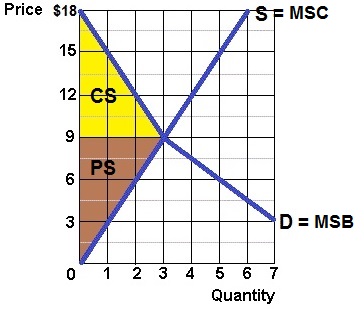

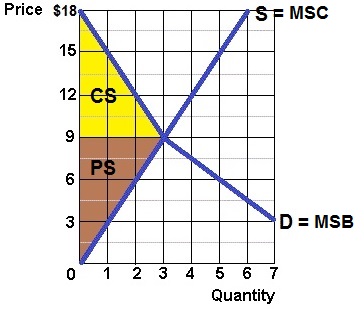

C. Consumer and Producer Surplus Model to show why the

equilbrium price maximizes society's satisfaction

1. Consumer Surplus

a. definition

- the difference between the maximum price a

consumer is (or consumers are) willing to pay for a

product and the actual price.

- The surplus, measurable in dollar terms, reflects

the extra utility gained from paying a lower price than

what is required to obtain the good.

c. graph

- Consumer surplus (CS) is measured and represented

graphically by the area under the demand curve and above

the equilibrium price.

-

c. calculate

- Consumer surplus can be measured by calculating

the difference between the maximum willingness to pay and

the actual price for each consumer, and then summing

those differences.

- d. Consumer surplus and price are inversely related -

all else equal, a higher price reduces consumer

surplus.

2. Producer Surplus

a. definition

- the difference between the actual price a producer

receives (or producers receive) and the minimum

acceptable price.

b. graph

- Producer surplus (PS) is measured and represented

graphically by the area above the supply curve and below

the equilibrium price.

c. calculate

- Producer surplus can be measured by calculating

the difference between the minimum acceptable price and

the actual price for each unit sold, and then summing

those differences.

d. Producer surplus and price are directly related -

all else equal, a higher price increases producer

surplus

3. Efficiency at equilibrium

a. Efficiency is attained at equilibrium, where

the combined consumer and producer surplus is maximized.

- Consumers receive utility up to their maximum

willingness to pay, but only have to pay the equilibrium

price.

- Producers receive the equilibrium price for each

unit, but it only costs the minimum acceptable price to

produce.

b. Allocative efficiency occurs at quantity levels

where three conditions exist:

- MB = MC (MSB = MSC)

- maximum willingness to pay = minimum acceptable

price

- combined consumer and producer surplus is at a

maximum

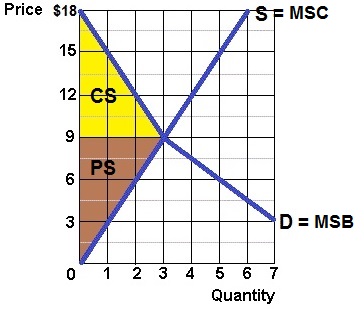

4. Allocative Inefficiency (Deadweight Losses)

a. producing too little:

- underproduction reduces both consumer and producer

surplus, and efficiency is lost because both buyers and

sellers would be willing to exchange a higher

quantity.

- the efficiency loss (deadweight loss) of producing

too little is the brown triangle on the figure below

- The sum of producer and consumer surplus at the

equilibirum level of output was the triangle

abc

- at the lower level of output the sum of

consumer and producer surplus is adec

- so the efficiency loss of producing too little

is the brown triangle dbe

- between Q2 and Q1 the maximum willingness to

pay of consumers is above the minimum acceptable price

of seller

b. producing too much:

- overproduction causes inefficiency because past

the equilibrium quantity, it costs society more to

produce the good than it is worth to the consumer in

terms of willingness to pay.

- the efficiency loss (deadweight loss) of producing

too little is the tan triangle on the figure below

- at the higher level of output the efficiency

loss caused by producing too much (Q3) is the tan

triangle bfg

- between Q1 and Q3 the maximum willingness to

pay of consumers is below the minimum acceptable price

of seller, this subtracts from society's net

benefit

Efficiency loss from underproduction = c + d

Efficiency loss from underproduction = e + f