CHAPTERS

10 and 13

Fiscal Policy

10a The Spending Multiplier

|

I.

Introduction

A. Review : Fiscal

Policy

1. Definition:

discretionary

fiscal policy

Deliberate

changes in taxes (tax rates) and government spending by

Congress to promote full-employment, price stability, and

economic growth.

2. Fiscal Policy

tools

a. government

purchases (spending)

b. taxes

c. both

3. Expansionary Fiscal

Policy

- An

increase in government expenditures for goods and services,

- a

decrease in taxes,

- or some

combination of the two

- for the

purpose of increasing aggregate demand and expanding real

output

- this

will reduce UE

4. Contractionary Fiscal

Policy

- a

decrease in government expenditures for goods and services,

- an

increase in net taxes,

- or some

combination of the two

- for the

purpose of decreasing aggregate demand and thus controlling

inflation.

FISCAL

POLICY

WE

ALREADY KNOW:

If

there is UE?

- increase

G

- decrease

T

- both

If

there is IN?

- decrease

G

- increase

T

- both

|

NOW WE

ARE GOING TO LEARN:

B. HOW MUCH Should the

Government Change G or T?

1. We know that: GDP =

C + Ig + G + Xn

a.

Assume:

1. equilibrium

GDP = $400 billion

2. full employment GDP = $500 billion

b. What change in G is

needed to achieve full employment?

c. graph

2. RESULT: Multiplier

effect

II. The

Multiplier Effect

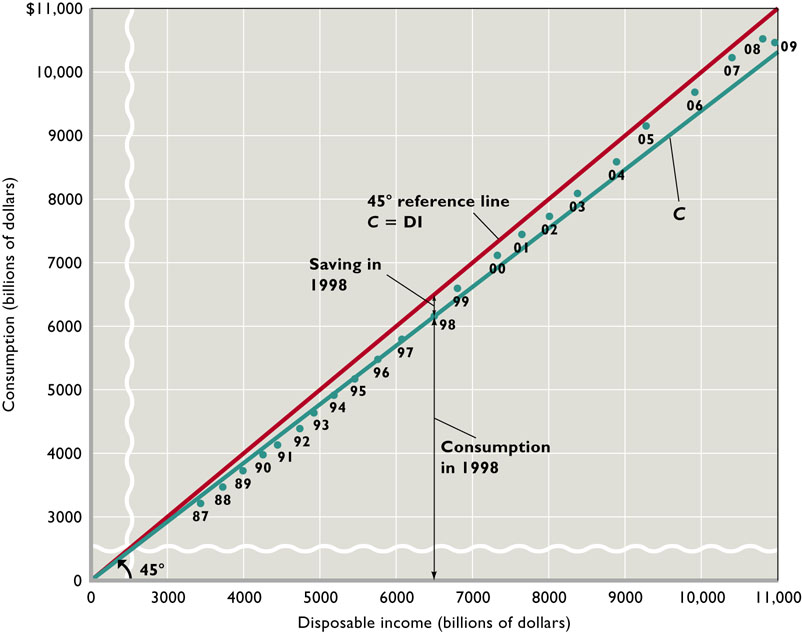

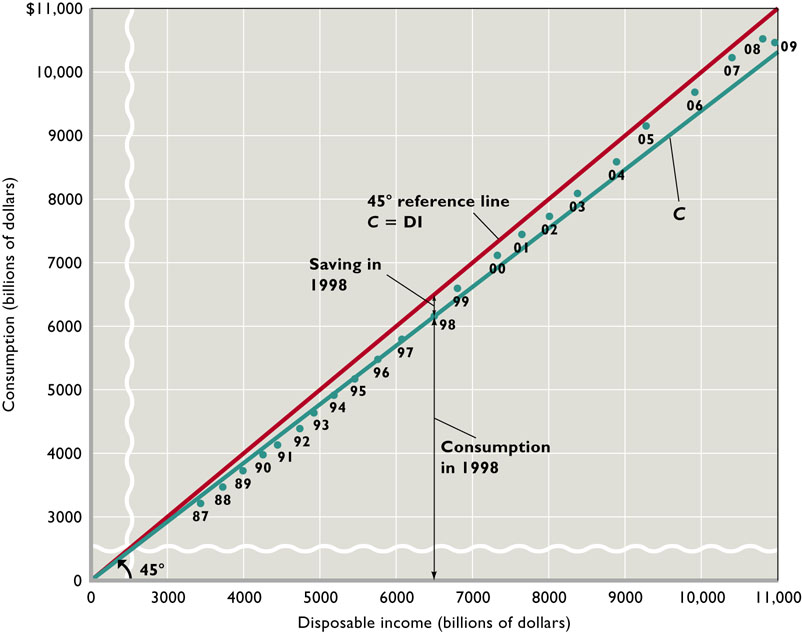

A. Consumption (C) and

Saving (S)

1.

introduction

a. DI = C + S

(ignoring taxes and imports)

b. the income

consumption-relationship (yellow page)

c. the income-saving

relationship (yellow page)

2. consumption and saving

schedules

a.

consumption schedule

1)

A schedule showing the amounts households plan to spend

for consumer goods at different levels of disposable

income.

2) average propensity

to consume (APC)

a)

definition

Fraction

(or percentage) of disposable income which households

plan to spend for consumer goods and services;

consumption divided by disposable income

b)

formula

b.

saving

schedule

1)

A schedule which shows the amounts households plan to

save (plan not to spend for consumer goods), at different

levels of disposable income.

2) saving and

dissaving

3) average propensity

to save (APS)

a)

definition

Fraction

(or percentage) of disposable income which

households save; saving divided by disposable

income.

b)

formula

c) APC + APS =

1

c. marginal propensity to

consume (MPC)

1)

definition

- The

fraction of any change in disposable income spent for

consumer goods;

- Equal

to the change in consumption divided by the change in

disposable income.

2)

formula

|

|

change

in C

|

|

MPC

=

|

-----------

|

|

|

change

in income

|

d. marginal propensity to

save (MPS)

1)

definition

- The

fraction of any change in disposable income which

households save;

- Equal

to the change in saving divided by the change in

disposable income.

2)

formula

|

|

change

in S

|

|

MPS

=

|

---------------

|

|

|

change

in income

|

3) MPC +MPS =

1

3. MPC and MPS

graphically

a. MPC = slope of

consumption function

|

|

change in

C

|

|

rise

|

|

|

|

MPC =

|

-----------

|

=

|

------

|

=

|

slope of

C

|

|

|

change in

income

|

|

run

|

|

|

Using the graph

above:

|

|

change in

C

|

|

80

|

|

|

|

MPC =

|

-----------

|

=

|

------

|

=

|

0.8

|

|

|

change in

income

|

|

100

|

|

|

b. MPS = slope of saving

function

|

|

change in

S

|

|

rise

|

|

|

|

MPS =

|

---------------

|

=

|

------

|

=

|

slope of S

|

|

|

change in

income

|

|

run

|

|

|

Using

the graph above:

|

|

change in

S

|

|

40

|

|

|

|

MPS =

|

---------------

|

=

|

------

|

=

|

0.2

|

|

|

change in

income

|

|

200

|

|

|

d. Are MPC and MPS really

constant - Are the consumption function and saving

function really straight lines?

NO - but it makes

calculations easier.

B Changing AD and The

Multiplier Effect assuming No Inflation

1. Definition:

Multiplier

The ratio of a

change in the equilibrium GDP to the change in investment or in

any other component of aggregate expenditures or aggregate

demand;

The number by

which a change in any component of aggregate expenditures or

aggregate demand must be multiplied to find the resulting

change in the equilibrium GDP.

2.  GDP

= initial spending x multiplier

GDP

= initial spending x multiplier

|

|

change in real

GDP

|

1

|

1

|

|

3. multiplier

=

|

-----------------------------------

|

= -------------------

|

= ------------------

|

|

|

initial change in

spending

|

MPS

|

1 - MPC

|

4. rationale -- how does the

multiplier work?

a. THIS IS

IMPORTANT!

(Be sure you understand figure 10.8: table

and

figure)

b. $20 billion bill in

class example (KNOW THIS!)

Assume: MPC = .8, and I increases by $20

billion

c. the multiplier and the

AS/AD graph: $20 billion bill in class

example

FROM TEXTBOOK (13.1)

d.

Does the multiplier work in reverse (if there is a decrease

in AD)? See: artbuchwaldmultiplier.htm

5. multiplier and marginal

propensities (slopes)

|

|

1

|

|

a. multiplier

=

|

-------

|

|

|

MPS

|

|

|

1

|

|

b. multiplier

=

|

------------

|

|

|

1 -

MPC

|

c. a larger MPC (or

smaller MPS) has a larger multiplier

6. The

Complex Multiplier (or the ACTUAL multiplier)

[REVIEW

MULTIPLIERS]

a. The Income =

Expenditures Stream (income becomes spending or

AD)

b. What ELSE can you do

with your Disposable Income (DI) besides spend

it?

- you can save it

- saving is a

"leakage" from the income = expenditure stream

- this creates the

simple multiplier

- you can also use it

to pay taxes (another "leakage" from the

income=expenditure stream )

- you can also spend it

on imports (another "leakage" from the income=expenditure

stream )

- so not all increases

in income become additional spending or

saving

- How does this affect

the size of the multiplier?

|

DI

|

|

|

C

|

|

|

AD

|

|

|

|

Leakages

|

|

Injections

|

|

|

|

|

|

S

|

|

I

|

|

|

|

|

|

T

|

|

G

|

|

|

|

|

|

M

|

|

X

|

|

|

c. If there are more

leakages, the multiplier is smaller

|

|

1

|

|

actual

multiplier =

|

-------------

|

|

|

leakages

|

d.

|

|

1

|

|

complex

multiplier =

|

-------------

|

|

|

MPS + MPT +

MPM

|

e. The Complex Multiplier

is SMALLER than the Simple Multiplier because there are more

leakages

(more is "torn" off

before additional income is spent).

III. Fiscal

Policy

Deliberate changes

in taxes (tax rates) and government spending by Congress to promote

full-employment, price stability, and economic growth.

A. Fiscal Policy and

Multipliers

REVIEW

MULTIPLIERS

1.  G

and the multiplier

G

and the multiplier

- we'll use the SIMPLE

multiplier

- simple multiplier =

1/MPS

2.  T

and the multiplier

T

and the multiplier

- we'll use the

lump-sum tax multiplier

a. lump-sum

tax

A

tax which is a constant amount (the tax revenue of

government is the same) at all levels of GDP.

b. the

lump-sum tax multiplier

1)

is always one less than the simple multiplier, but

negative ( =

simple multiplier - 1)

2)

lump-sum tax multiplier = -MPC / MPS

3.  G

AND

G

AND  T

and the Multiplier

T

and the Multiplier

a.  's

in G AND

's

in G AND  's

in T can be used in combination

's

in T can be used in combination

b. "balanced budget"

multiplier = 1

- what happens to the

governmet's budget if they use expansionary

FP?

- What

if the government changes both G and T by the same amount

and in the same direction? Will GDP change?

- increase

G increase GDP, but HOW MUCH?

- increase

T decreases GDP, but HOW MUCH?

- The

'balanced budget multiplier" always has a value of 1

since the tax multiplier is always one less than the

government spending multiplier

V. Built-in

Stability

A. When the economy

enters a recession the government could:

- use expasionary FP

(discretionary FP)

- do NOTHING

(nondiscretionary FP)

B. What if the economy enters a

recession and the government does NOTHING what

happens?

- If Taxes are directly

related to GDP (income),

- and Transfer Payments

(welfare) are indirectly related to GDP,

- what happens to AD after

entering a recession?

- taxes

decrease

- government spending on

welfare increases

- so AD increases even

though the government did nothing

C. Built-in

Stabilizer

A

mechanism which increases government’s budget deficit (or

reduces its surplus) during a recession and increases

government’s budget surplus (or reduces its deficit)

during inflation without any action by policy makers;

the tax

system is one such mechanism.

D. Tax

Progressivity

- A tax

system wherein the average tax rate (tax revenue/GDP) rises

with GDP.

- The more

progressive the tax system, the greater the economy's built-in

stability.

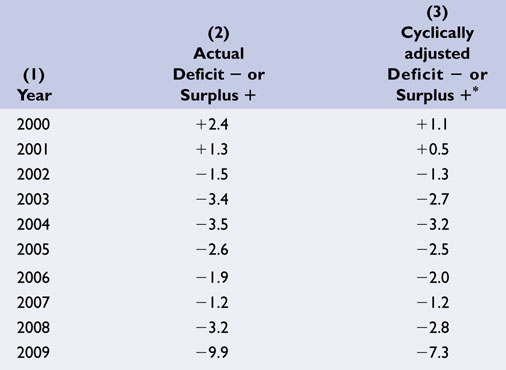

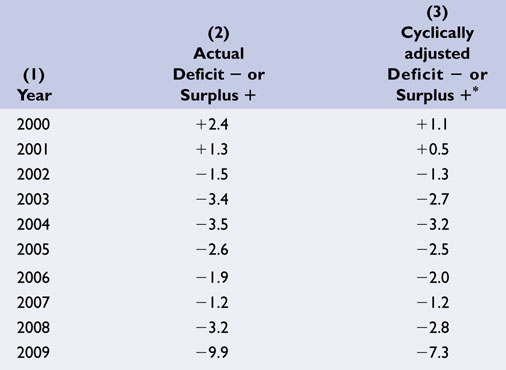

IV. Evaluating Fiscal Policy:

Cyclically-Adjusted Budget (also called the Full-Employment or

Standardized Budget)

What happens to the government budget

deficit if it uses expansionary FP?

What happens to the government budget deficit if the

economy enters a recession and the government does

NOTHING?

So, if the government budget deficit increases when the

economy enters a recession, does this indicate that the

government is doing some SOMETHING (expansionary FP) or

NOTHING?

Since deficits increase during recessions whether the

government does SOMETHING or NOTHING we cannot use larger

deficits as an indicator that the government is doing

something.

Therefore,

economists have created a the concept of a "full employment

budget"

|

An increase in the cyclically adjusted

(standardized or full-employment) budget

deficit is an

indicator of discretionary expansionary FP

|

- actual

budget

A

listing of amounts spent by the Federal government (to

purchase goods and services and for transfer payments) and

the amounts of tax revenue collected by it in any (fiscal)

year.

- cyclical

deficit

A

Federal budget deficit which is caused by a recession and

the consequent decline in tax revenues.

GRAPH

-

cyclically-adjusted (full-employment or standardized)

budget

A

comparison of the government expenditures and tax

collections which WOULD occur if the economy operated at

full employment throughout the year.

GRAPH

- structural

deficit

The

extent to which the Federal government’s expenditures

exceed its tax revenues when the economy is at full

employment (or the extent to which its current expenditures

exceed the projected tax revenues which would accrue if the

economy were at full employment); also known as a

full-employment budget deficit.

V. Problems,

Criticisms, and Complications

A. Problems of

Timing

1. RECOGNITION LAG is

the elapsed time between the beginning of recession or

inflation and awareness of this occurrence.

2. ADMINISTRATIVE LAG is the

difficulty in changing policy once the problem has been

recognized.

3. OPERATIONAL LAG is the

time elapsed between change in policy and its impact on the

economy.

B. Political

Considerations:

Government has other goals besides economic stability, and these

may conflict with stabilization policy.

1. A political

business cycle may destabilize the economy:

Election years have

been characterized by more expansionary policies regardless

of economic conditions. Some call this a political business

cycle:

The

alleged tendency of Congress to destabilize the economy by

reducing taxes and increasing government expenditures before

elections and to raise taxes and lower expenditures after

elections.

2. State and local finance

policies may offset federal stabilization policies.

They are often

procyclical, because balanced-budget requirements cause

states and local governments to raise taxes in a recession

or cut spending making the recession possibly

worse.

In an inflationary

period, they may increase spending or cut taxes as their

budgets head for surplus.

3. The crowding-out effect

may be caused by fiscal policy.

a.

REVIEW

MULTIPLIERS

b. DEFINITION: Crowding

Out Effect

A

rise in interest rates and a resulting decrease in

planned investment caused by the Federal

government’s increased borrowing in the money

market.

c. "Crowding-out" may

occur with government deficit spending.

It may increase

the interest rate and reduce private spending which

weakens or cancels the stimulus of fiscal

policy.

d. Some economists argue

that little crowding out will occur during a

recession.

e. Economists agree that

government deficits should not occur at FE.,

f. it is also argued that

monetary authorities could counteract the crowding-out by

increasing the money supply to accommodate the expansionary

fiscal policy.

VII. Supply-Side Fiscal Policy and

the Multiplier

A. What is "Supply-Side

FP" ?

1. The

contention that tax reductions will shift the aggregate supply

curve to the right.

(see the graph

below).

2. There are

three main reasons for this:

a.

Saving and investment - lower taxes will increase disposable

incomes, thereby increasing household savings, lowering

interest rates, and increase investment in new

technology

b. Work

incentives – lower tax rates will increase after tax

wages from work, thereby increasing work incentives and

productivity,

therefore, shift supply to the right.,

c. Risk

Taking – lower tax rates prod risk taking individuals

and businesses to risk their energy and financial capital on

new production methods and new products

and, therefore,

shift supply to the right.

B. Effect on the

multiplier - REVIEW

MULTIPLIERS

Larger multiplier:

instead of going from Q1 to Q2 (simple multiplier) the economy

goes to Q3

C. Supply side

economists sometimes argue that if lower taxes raise GDP, tax

revenues may actually rise.

Laffer

Curve

D. Many economists are

skeptical of supply-side theories.

1. Effect of lower

taxes on a supply is not supported by evidence.

2. Tax impact on supply

takes extended time, but demand impact is more

immediate.

13b Other Fiscal Policy Issues and Government Debt

|

VIII. Other FP Issues

A. Policy in the Great Depression (see videos)

B. New Keynesian and New Classical FP (see videos)

B. Government Budget Deficits and Trade (see videos)

IX. The U.S. Public Debt

A. Introduction

1. OPTIONAL

CNN Deficit and Dept Quiz (2011):

http://money.cnn.com/quizzes/2010/news/fiscal-debt/index.html

2. Debt vs. Deficit

a. The national or public debt is the TOTAL

accumulation of the Federal government's total deficits and

surpluses that have occurred through time.

b. The federal government's budget DEFICITS and

SURPLUSES are ANNUAL differences between the revenue

collected and government spending.

3. Size of the debt: TOTAL DEBT

a. $7.96 trillion in 2005.

b. $ 11.9 trillion in 2009

c. $16.4 trillion in 2012

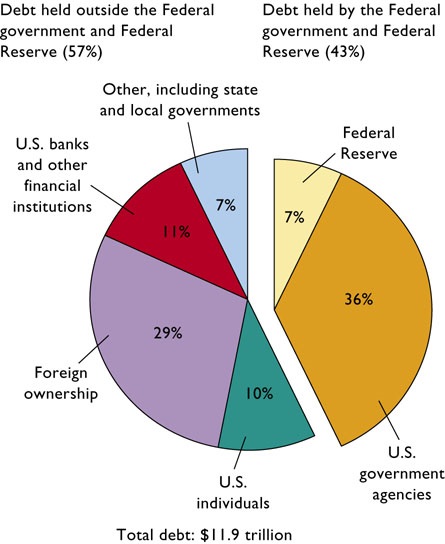

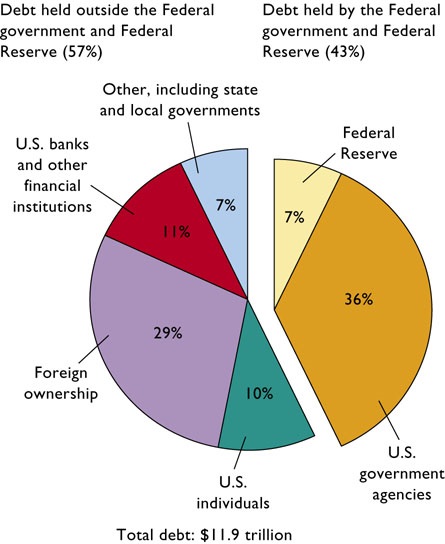

B. Ownership of the public debt

1. Debt Held by the Public – all federal debt

held by individuals, corporations, state or local governments,

foreign governments and other entities outside of the United

States government.

2012: 60% of total debt

- 33% foreign owned (China owns about a quarter, Japan

a fifth)

- 10% owned by banks,etc.

- 6% owned by US individuals

- 11% Other including state and local

governments

2. Intragovernmental Holdings – government

securities held by government trust funds, such as the Social

Security trust fund and the Medicare trust fund, and the

Federal Reserve.

2012: 40%

- 29% US government agencies

- 11% Federal Reserve

2009

3. International comparison

https://www.cia.gov/library/publications/the-world-factbook/rankorder/2186rank.html

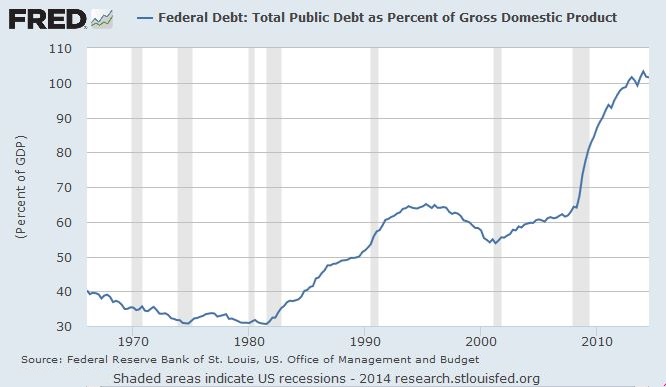

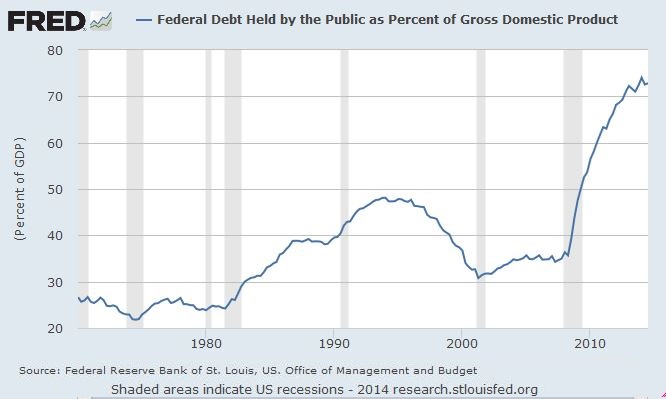

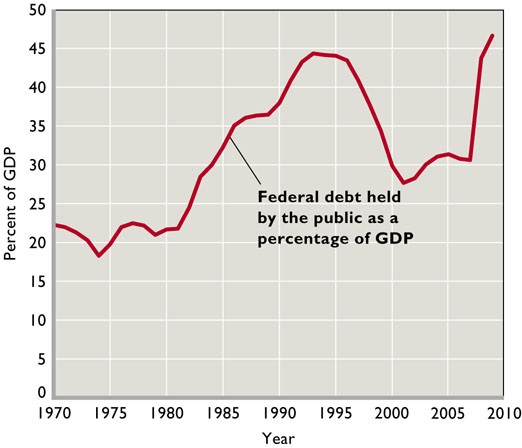

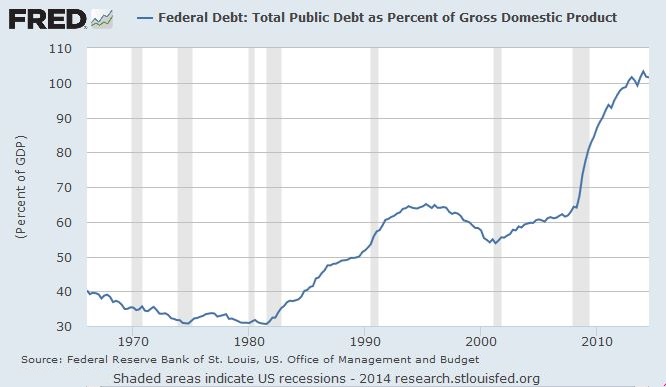

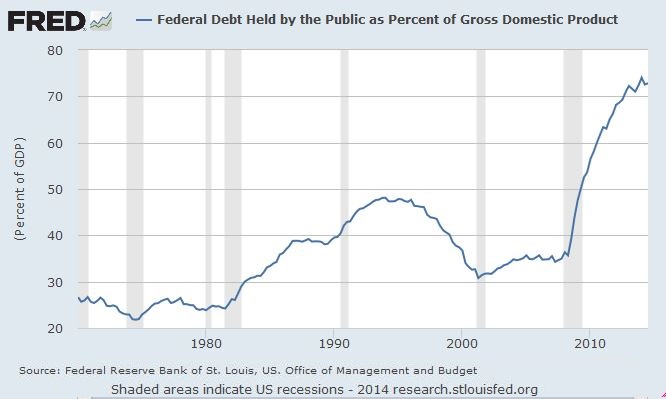

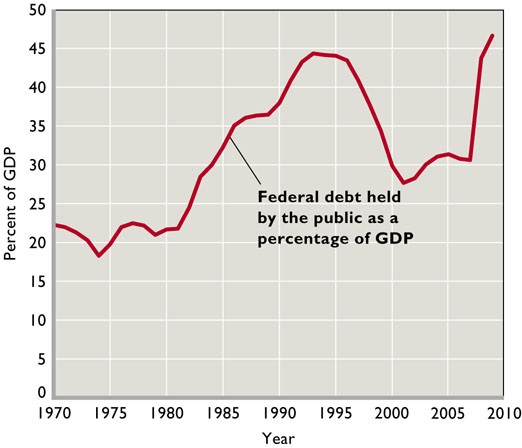

C. Debt and GDP

1. Debt: TOTAL vs. % GDP

2. PUBLIC DEBT as a % of GDP

D. False Concerns of a Large Public Debt

1. Bankruptcy

a. refinancing

b. taxation

2. Burdening Future Generations

E. Substative Issues of a Large Public Debt (see

below)

1. Income Distribution

2. Incentives

3. Foreign-Owned Public Debt

4. Crowding out of Private Investment

G. The

Future

The nonpartisan CBO in

September of 2013 released a study warning that the next few

years of declining deficits will be followed by a surge of red

ink to cover the mounting costs of Social Security, Medicare

and Medicaid.

The federal

government’s net interest payments would grow to 5 percent

of GDP, compared with an average of 2 percent over the past 40

years, mainly because federal debt would be much larger and

interest rates will rise.

Federal spending for Social

Security, Medicare and Medicaid would increase to a total of 14

percent of GDP by 2038, or twice the 7 percent average of the

past 40 years.

http://www.thefiscaltimes.com/Articles/2013/09/17/CBO-Interest-Rates-Will-Spike-Debt-100-GDP

Substantive Issues

Interest charges are the main burden imposed

by the debt. Interest on the debt was $360 billion in

2012, or 2.3% of GDP

Repayment of the debt affects income distribution.

If working taxpayers will be paying interest to the mainly

wealthier groups who hold the bonds, this probably increases

income inequality.

Since interest must be paid out of government

revenues, a large debt and high interest can increase tax

burden and may decrease incentives to work, save, and

invest for taxpayers.

A higher proportion of the debt is owed to

foreigners than in the past, and this can increase the

burden since payments leave the country. But Americans also own

foreign bonds and this offsets the concern. Foreigners

held about 25 percent of the public debt in 2005., 33% in

2012

Some economists believe that public borrowing crowds

out private investment, but the extent of this effect is

not clear

There are some positive aspects of borrowing

even with crowding out.

1. If borrowing is for public investment that

causes the economy to grow more in the future, the burden

on future generations will be less than if the government

had not borrowed for this purpose.

2. Public investment makes private investment more

attractive. For example, new federal buildings generate

private business; good highways help private shipping,

etc.

|