PREVIEW:

- Chapter 15 Formulas

- Chapter 15 Money Creation Yellow Page Activity

- Review: Short-answer

- Review: Multiple choice

- Assignments

- Online Lecture

15a How Banks Create Money |

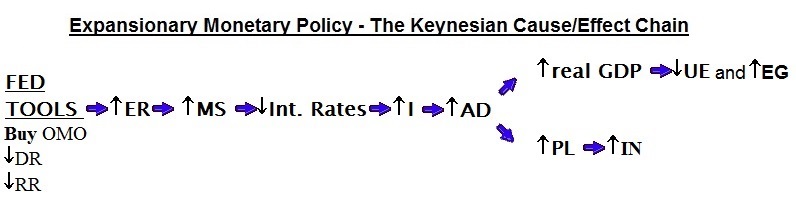

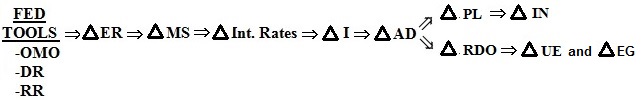

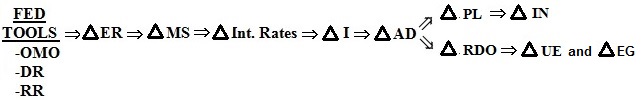

I. PREVIEW / REVIEW The following figures and graphs illustrate what we learn in chapters 10, 12, 14, 15, and 16

II. What we learned in chapter 12

- a change in the money supply (

MS)

causes a change in interest rates

(

MS)

causes a change in interest rates

( Int.

Rates)

Int.

Rates) - a change in interest rates (

Int.

Rates) results in a change in Investment

(

Int.

Rates) results in a change in Investment

( I)

I) - a change in Investment (

I)

will change Aggregate Demand (

I)

will change Aggregate Demand ( AD)

AD) - a change Aggregate Demand (

AD)

will change real GDP and therefore unemployment

(

AD)

will change real GDP and therefore unemployment

( real

GDP

real

GDP

UE)

UE) - change Aggregate Demand (

AD)

will also change the price level, assuming we are in the

intermediate range of the AS curve, and therefore it will also

change inflation (

AD)

will also change the price level, assuming we are in the

intermediate range of the AS curve, and therefore it will also

change inflation ( Price

Level

Price

Level

IN).

See the figure below and the graph.

IN).

See the figure below and the graph.

C. Chapter 14 (part of 16)

- we learn how a change in the money supply

(

MS)

creates a change in interest rates

(

MS)

creates a change in interest rates

( Int.

Rates).

Int.

Rates). - See figure above and the graph below.

III. In chapter 10 of the textbook

1. Investment consists of spending on new plants, capital equipment, machinery, inventories, construction, etc.2. The expected rate of return is found by comparing the expected economic profit (total revenue minus total cost) to the cost of investment to get the expected rate of return. The text's example gives $100 expected profit on a $1000 investment, for a 10% expected rate of return. Thus, the business would not want to pay more than a 10% interest rate on investment. Remember that the expected rate of return is not a guaranteed rate of return. Investment carries risk.

3. The real interest rate, i (nominal rate corrected for expected inflation), determines the cost of investment.

a. The interest rate represents either the cost of borrowed funds or the opportunity cost of investing your own funds, which is income forgone.b. If real interest rate exceeds the expected rate of return, the investment should not be made.

4. Investment demand schedule, or curve, shows an inverse relationship between the interest rate and amount of investment.

a. As long as expected return exceeds the interest rate, the investment is expected to be profitableb. Figure 10-5 shows the relationship when the investment rule is followed. Fewer projects are expected to provide high return, so less will be invested if interest rates are high.

Figure 10.5

5. graph

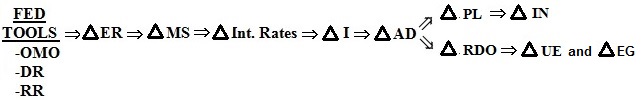

IV. Putting chapters 10, 12, and 14 (part of 16) together.

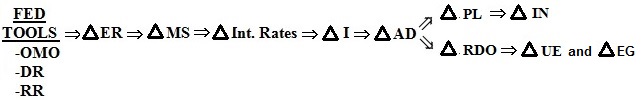

IF the MS increases:

FIRST: Chapter 14 (part of 16) THEN: Chapter 10 FINALLY: Chapter 12 If the MS increases: If the interest rates decline: If investment increases:

WHAT IS LEFT TO LEARN?

V. Chapter 15: How Banks Create Money

- We learn how money is created to increase the money supply (MS)

Excess reserves causes a change in the money supply

(

Excess reserves causes a change in the money supply

( ER

ER

MS)

MS)

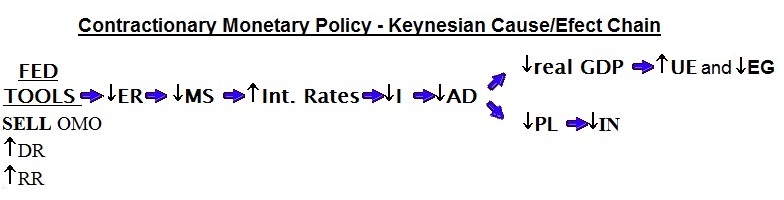

VI. Chapter 16 - How the Federal Reserve (the "Fed") controls the money supply: FED TOOLS

- open market operations (OMO)

- changing the discount rate (DR)

- changing the require reserve ratio (RR)

VII. ONCE WE HAVE LEARNED IT ALL:

A. If there is HIGH UNEMPLOYMENT in the economy, the appropriate monetary policy policy and its effect illustrated on our graphs would be:

FIRST: Chapters 15 and 16 SECOND: Chapter 14 (part of 16) THIRD: Chapter 10 FINALLY: Chapter 12 To increase the MS the Fed must increase the ER of

banks. Then banks could make more loans and create more

money. To do this they would use an easy money

policy. Easy Money Policy: If the MS increases: If the interest rates decline: If investment increases:

![]() DR)

DR)![]() RR)

RR)

VII. One More Thing to Review: what is money - M1?

- We will use M1 as our money supply (MS)

- M1 is currency and checkable deposits

IX. Goldsmith Banking: the origin of the fractional reserve system of banking

A. Money Creation and Reserves1. In the 16th century gold was used as a medium of exchange (money)2. Goldsmiths had safes for gold and precious metals. Often consumers and merchants would keep their gold (money) in these safes.

3. The goldsmiths issued receipts for these deposits.

4. These receipts came to be used as MONEY in place of gold because of their convenience.

5. Goldsmiths became aware that much of the stored gold was never redeemed, people just used the receipts

6. Goldsmiths realized they could "loan" gold by issuing more receipts to borrowers, who agreed to pay back gold plus interest. HENCE, THE GOLDSMITHS CREATED MONEY.

7. Such loans began "fractional reserve banking," because the actual gold in the vaults became only a fraction of the receipts held by borrowers and owners of gold.

8. Significance of fractional reserve banking: banks can create money by lending more than the original reserves on hand. (Note: Today gold is not used as reserves).

B. Significant characteristics of Fractional Reserve Banking

1. when banks make loans, the create money2. Bank panics and Regulation

a. The amount of gold in the goldsmith's safe was less than the value of the receipts circulating as moneyb. Present day banks also lend more than the deposits on hand. Not all depositors can get their money back at once.

c. Therefore lending policies must be prudent to prevent bank "panics" or "runs" by depositors worried about their funds.

d. Just like in the movie "It's a Wonderful Life"

e. Also, the U.S. government's deposit insurance system prevents panics by insuring deposits up to $100,000.

X. How a bank creates money when it grants a loan: A Single Bank and a Cash Deposit

If you are confused by this yellow page activity, the whole thing is written out and explained at the following websites:

A. Balance Sheet of a Bank

1. A balance sheet states the assets and claims of a bank at some point in time.2. All balance sheets must balance, that is, the value of assets must equal value of claims.

a. The bank owners’ claim is called net worth.b. Nonowners’ claims are called liabilities.

3. Basic equation: Assets = liabilities + net worth.

a. assets = what a bank OWNS(1) The assets of a bank include:

- cash in the vault

- deposits at the Fed. (all member banks keep deposits at the Fed. Nonmember banks keep deposits at a member bank. These deposits are used by the Fed to help banks "clear" checks.

- loans made to customers

- government securities (bonds) bought by the banks

- Other (the building, computers, land, etc.)

(2) The banks RESERVES are its cash in vault + deposits at the Fed

(3) A banks interest earning assets are its loans and government securities

b. liabilities = what a bank OWES

The liabilities of a bank include:

- Checking deposits of customers (called Demand Deposits or DD)

- Savings Accounts and CDs of customers

- Loans borrowed by the bank from the Fed or other banks

c. net worth

Net worth is what is left over IF a bank goes out of business selling all of its assets and paying off all of its liabilities.Assets - Liabilities = Net WorthThey are also called "owner's equity". It's what the owners of the bank have in the bank, i.e. what is left over after seeing their assets and paying off their liabilities.

d. the balance sheet or T-account:

ASSETS LIABILITIES & NET WORTH

- cash in the vault

- deposits at the Fed. (all member banks keep deposits at the Fed. Nonmember banks keep deposits at a member bank. These deposits are used by the Fed to help banks "clear" checks.

- loans made to customers

- government securities (bonds) bought by the banks

- Other (the building, computers, land, etc.)

- Checking deposits of customers (call Demand Deposits (DD)

- Savings Accounts and CDs of customers

- Loans borrowed by the bank from the Fed or other banks

- Net Worth

ASSETS LIABILITIES & NET WORTH

- cash in the vault

- deposits at the Fed.

- loans made to customers

- government securities (bonds) bought by the banks

- Other (the building, computers, land, etc.)

- Checking deposits of customers (call Demand Deposits (DD)

- Savings Accounts and CDs of customers

- Loans borrowed by the bank from the Fed or other banks

- Net Worth

B. Bank Reserves:

[Chapter 15 Formulas]1. Total Reserves = Cash in Vault + Deposits at Fed.

(also called "actual reserves")2. Required Reserves = RR x Liabilities

- NOTE! Students often forget this !!!!!!!!!!!!

- RR = Reserve Ratio

- Liabilities are the Demand Deposits or DD (checking accounts of the bank's customers)

- The required reserves are a requirement of all banks.

- Banks must keep a fraction of their reserves that they can not use.

- These are not kept to pay back depositors.

- The required reserves are required by the Fed as a means to control the money supply (see chapter 14).

- See: http://www.federalreserve.gov/monetarypolicy/reservereq.htm

- If I put $10 in my checking account, how much is the bank required to keep?

PREVIOUS RESERVE REQUIREMENTS:

Type of liability

Requirement

Percentage of liabilities

Effective date

Net transaction accounts 1

$0 to $7.0 million 2

0

12-23-04

More than $7.0 million to $47.6 million 3

3

12-23-04

More than $47.6 million

10

12-23-04

Nonpersonal time deposits

0

12-27-90

Eurocurrency liabilities

0

12-27-90

NEW RESERVE REQUIREMENTS:

Reserve Requirements

Liability Type

Requirement

% of liabilities

Effective date

Net transaction accounts 1

$0 to $11.5 million2

0

12-29-11

More than $11.5 million to $71.0 million3

3

12-29-11

More than $71.0 million

10

12-29-11

Nonpersonal time deposits

0

12-27-90

Eurocurrency liabilities

0

12-27-90

From the Fed:

- Required reserves must be held in the form of vault cash and,

- if vault cash is insufficient, also in the form of a deposit maintained with a Federal Reserve Bank.

- An institution that is a member of the Federal Reserve System must hold that deposit directly with a Reserve Bank;

- an institution that is not a member of the System can maintain that deposit directly with a Reserve Bank or with another institution in a pass-through relationship.

- Reserve requirements are imposed on commercial banks, savings banks, savings and loan associations, credit unions, U.S. branches and agencies of foreign banks, Edge corporations, and agreement corporations.

1. Total transaction accounts consists of demand deposits, automatic transfer service (ATS) accounts, NOW accounts, share draft accounts, telephone or preauthorized transfer accounts, ineligible bankers acceptances, and obligations issued by affiliates maturing in seven days or less. Net transaction accounts are total transaction accounts less amounts due from other depository institutions and less cash items in the process of collection. For a more detailed description of these deposit types, see Form FR 2900 at http://www.federalreserve.gov/boarddocs/reportforms/

2. The amount of net transaction accounts subject to a reserve requirement ratio of zero percent (the "exemption amount") is adjusted each year by statute. The exemption amount is adjusted upward by 80 percent of the previous year's (June 30 to June 30) rate of increase in total reservable liabilities at all depository institutions. No adjustment is made in the event of a decrease in such liabilities.

3. The amount of net transaction accounts subject to a reserve requirement ratio of 3 percent is the "low-reserve tranche." By statute, the upper limit of the low-reserve tranche is adjusted each year by 80 percent of the previous year's (June 30 to June 30) rate of increase or decrease in net transaction accounts held by all depository institutions.

3. Excess Reserves = Total Reserves - Required Reserves

Excess reserves are used by banks to:

- pay back depositors (like when I write a check - my bank uses its excess reserves to cover that check)

- to make loans (this is one way that banks earn revenue)

- to buy government securities (another way for banks to earn revenue - it is like loaning funds to the US government)

4. Reserve Formulas Summary

1. Total Reserves = cash in vault + Deposits at Fed.

2. Required Reserves = RR x Liabilities

3. Excess Reserves = Total Reserves - Required Reserves

C. $10 Cash Deposit into a person's checking (DD) account

[you may want to see the chapter 15 online lecture]1. balance sheet changes

- liabilities increase (DD)

- assets increase (total reserves)

- calculate change in required required reserves

- calculate change in excess reserves

2. effect on M1: NONE

3. but there is a change in excess reserves (ER)D. Money Creation granting a loan

1. banks use excess reserves to make loans or to buy security2. balance sheet changes if they grant a loan equal to their excess reserves

- Assets

- loans increase

- liabilities

- loan is given as a deposit into the borrower's checking account so DD increases

- THIS IS NEW MONEY -- MONEY HAS BEEN CREATED

3. assume the borrower spends the loan by writing a check and the check CLEARS

- Clearing the check means that the bank that received the check wants to receive reserves from the bank on which the check was written (the check that made the loan)

- so the bank the made the loan send reserves to the bank that received the check

- now the bank that made the LOAN HAS NO MORE EXCESS RESERVES AND CAN'T MAKE ANY MORE LOANS

- but, the bank that received the check now has more total reserves and more liabilities

- we can now again calculate THIS bank's required reserves and excess reserves

- The excess reserves cam be use to make a loan AND CREATE MORE MONEY

- the process can continue and continue creating more money

XI. How much money (MS) can the Banking System create?: Multiple Deposit Expansion

A. SUMMARY: Money Supply Changes:

From the yellow pages:1. How much money was created in round one? ____$ 8____2. How much money was created in round two? ____$ 6.40_

3. How much money can be created in round three? ____$ 5.12_

B. If the process continued with each additional bank making loans equal to its excess reserves, the maximum possible change in the money supply will be:

Total Change in Money Supply = initial excess reserves X money multiplier

C. What is the money multiplier?

money multiplier = 1/RR - 1/.2 = 5

D. What is the maximum total increase in the money supply that can occur as a result of the initial $10 cash deposit? ____$ 40_____

From the yellow page:

Change in the MS = ER x money multiplier = $8 x 5 = $40

XII. What are the limitations on this money creation process?

The formula above gives us the MAXIMUM possible change in the money supply. The chapter’s discussion of bank credit is in terms of the maximum money-creating potential that would probably not ever be reached due to these modifications introduced at the end of this chapter:1) banks may hold ER

2) people may hold money

3) the required reserve ratio

If you are confused by this yellow page activity, the

whole thing is written out and explained at: