Chapter 16

Monetary Policy

I. Introduction

A. Objectives of Monetary Policy

1. The fundamental objective of monetary policy is

to aid the economy in achieving full-employment output with

stable prices.

a. To do this, the Fed changes the nation’s

money supply.

b. To change money supply, the Fed manipulates size of

excess reserves held by banks (see chapter 15).

c. the Fed has four tools to do this

- Open Market Operations (OMO)

- changing the discount rate (DR)

- changing the required reserve ratio (RR)

- Term Auction Facility (similar to DR)

2. Monetary policy has a very powerful impact on the

economy, and the Chairman of the Fed’s Board of Governors,

Ben Bernanke currently, is sometimes called the second most

powerful person in the U.S.

B. Functions of The Federal Reserve System (Fed)

1. issue currency = Federal Reserve Notes

2. setting reserve requirements

3. lending money to banks and thrifts (the discount rate -DR-

is the interest rate banks are charged for borrowing from the

Fed

4. providing for check collection

3. acting as fiscal agent for the US government

4. supervising banks

5.

controlling

the money supply

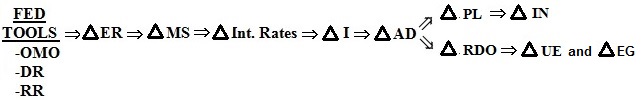

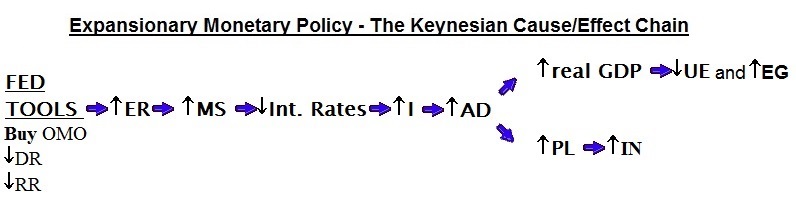

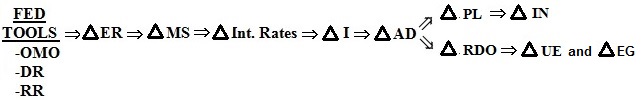

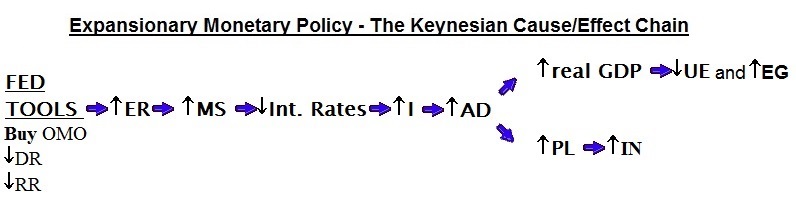

C. REVIEW / PREVIEW: Monetary Policy: Keynesian Cause-Effect

Chain

1. A change in the Fed tools CAUSES

2. a change in excess reserves CAUSES

3. a change in the money supply CAUSES

4. a change in the interest rate CAUSES

5. a change in investment CAUSE

6. a change in aggregate demand CAUSES

7. a change in real GDP and a change in the price level

CAUSES

8. a change in unemployment and/or inflation

D. REVIEW /PREVIEW EXAMPLE:

If there is HIGH UNEMPLOYMENT in the economy, the

appropriate monetary policy policy and its effect illustrated on

our graphs would be:

|

FIRST: Chapters 15 and 16

|

SECOND: Chapter 14

|

THIRD: Chapter 10

|

FINALLY: Chapters 12 and 13

|

|

To increase the MS the fed must increase the ER of

banks.

Then banks could make more loans and create more

money.

To do this they would use an easy money

policy.

|

|

|

|

|

Easy Money Policy:

- buy securities on the open

market (OMO buy)

- lower the DR (

DR)

DR)

- decrease the required

reserve ratio (

RR) RR)

- Auction more

reserves

|

If the MS increases:

- Chapter 14

- MS shifts to the right

- interest rates decline

|

If the interest rates decline:

- the amount of investment increases

- there is a movement along the graph

- NOTE: the Investment demand graph does not shift

|

If investment increases:

- AD shifts to the right (increases)

- we have the chapter 13 multiplier effect

- real GDP increase and UE decreases

- the price level may increase causing more

inflation

|

|

|

|

|

|

MONETARY POLICY

II. Balance Sheet of the Fed

A. two major Assets

1. Securities which are federal government bonds

purchased by Fed, and

2. Loans to commercial banks (Note: again commercial

banks term is used even though the chapter analysis also

applies to other thrift institutions.)

B. three major Liabilities

1. Reserves of banks held as deposits at Federal

Reserve Banks,

2. U.S. Treasury deposits of tax receipts and borrowed

funds, and

3. Federal Reserve Notes outstanding, our paper

currency.

|

ASSETS

|

|

||

|

LIABILITIES

|

|

|

Securities

|

|

||

|

Reserves of banks

|

|

|

Loans to banks

|

|

||

|

Treasury deposits

|

|

|

other

|

|

||

|

Federal Res. Notes

|

|

|

|

|

||

|

other

|

|

|

|

|

|

|

|

III. The Tools of Monetary Policy

A. Three Tools of the Fed over the Money Supply

1. open market operations (OMO)

2. changing the reserve ratio (RR)

3. changing the discount rate (DR)

B. Open Market Operations

1. definition

Open-market operations refer to the Fed’s

buying and selling of government bonds.

2. buying securities

Buying securities will increase bank reserves and the money

supply

a. Example: Assume that the Fed buys a $1000

bond (security) from a commercial bank (RR = 20%)

1) then bank reserves go up by the value of the

securities sold to the Fed.

2) impact on balance sheets

|

Balance Sheet of the Fed

|

|

ASSETS

|

|

||

|

LIABILITIES

|

|

|

|

|

|

|

|

|

Securities

|

+ $1000

|

||

|

Reserves of banks

|

+ $1000

|

|

Loans to banks

|

|

||

|

Treasury deposits

|

|

|

other

|

|

||

|

Federal Res. Notes

|

|

|

|

|

||

|

other

|

|

|

|

|

|

|

|

|

|

Balance Sheet of the Banking

System

|

|

ASSETS

|

|

||

|

LIABILITIES

|

|

|

|

|

|

|

|

|

Reserves at Fed

|

+ $1000

|

||

|

Demand Deposits

|

|

|

Cash in vault

|

|

||

|

Other Deposits

|

|

|

Loans

|

|

||

|

Loans from Fed

|

|

|

Securities

|

- $1000

|

||

|

other

|

|

|

Other

|

|

||

|

|

|

|

3) When Fed buys bonds from

bankers, reserves rise and excess reserves rise by same

amount since no checkable deposit was created.

4) more excess reserves increases Bank's lending

ability -- remember when banks make loans they creat

money

5) Total change in the money supply:

MS

= initial ER x money multiplier

MS

= initial ER x money multiplier

- money multiplier = 1 / RR = 1/.2 = 5

- SO:

MS

= + $1000 x 5 = + $5000

MS

= + $1000 x 5 = + $5000

6) Textbook Figure 16.2

b. Example: Assume that the Fed buys a $1000

bond (security) from the general public (RR = 20%)

1) people receive checks from the Fed and then

deposit the checks at their bank. Bank customer's

deposits rise and therefore bank reserves rise by the

same amount. NOTE: this $1000 in new demand deposits is

NEW MONEY

2) impact on balance sheets

|

Balance Sheet of the Fed

|

|

ASSETS

|

|

||

|

LIABILITIES

|

|

|

|

|

|

|

|

|

Securities

|

+ $1000

|

||

|

Reserves of banks

|

+ $1000

|

|

Loans to banks

|

|

||

|

Treasury deposits

|

|

|

other

|

|

||

|

Federal Res. Notes

|

|

|

|

|

||

|

other

|

|

|

|

|

|

|

|

|

|

Balance Sheet of the Banking

System

|

|

ASSETS

|

|

||

|

LIABILITIES

|

|

|

|

|

|

|

|

|

Reserves at Fed

|

+ $1000

|

||

|

Demand Deposits

|

+ $ 1000

(this is new M1 money)

|

|

Cash in vault

|

|

||

|

Other Deposits

|

|

|

Loans

|

|

||

|

Loans from Fed

|

|

|

Securities

|

|

||

|

other

|

|

|

Other

|

|

||

|

|

|

|

3) Banks’ lending ability

rises with new excess reserves of $800. When Fed buys

from public, some of the new reserves are

required reserves for the

new checkable deposits.

4) Total change in the money supply:

MS

= initial ER x money multiplier

MS

= initial ER x money multiplier

- money multiplier = 1 / RR = 1/.2 = 5

- SO:

MS

= + $ 800 x 5 = + $ 4000 PLUS the initial $1000 of new

money created when the fed paid the public for the

gov't security = $ 5000

MS

= + $ 800 x 5 = + $ 4000 PLUS the initial $1000 of new

money created when the fed paid the public for the

gov't security = $ 5000

4) Textbook Figure 16.2

c. Conclusion:

When the Fed buys securities, bank reserves will

increase and the money supply potentially can rise by a

multiple of these reserves.

The Fed pays for the securities with new Excess

Resources (ER)

MS

= initial ER x money multiplier

MS

= initial ER x money multiplier

OR

MS

= value of securities bought x money

multiplier

MS

= value of securities bought x money

multiplier

The Fed would do this to fight unemployment (UE)

3. When the Fed sells securities:

a. the points above will be reversed.

b. Bank reserves will go down, and eventually the money

supply will go down by a multiple of the banks’

decrease in reserves.

c. they would do this to fight inflation (IN)

|

Three tools of the fed:

1. OMO

2. RR

3. DR

|

C. Changing the Reserve Ratio

1. raising the reserve ratio

a. Raising the reserve ratio increases required

reserves and shrinks excess reserves.

b. Any loss of excess reserves shrinks banks’

lending ability and, therefore, DECREASES the potential

money supply by a multiple amount of the change in excess

reserves.

2. lowering the reserve ratio

a. Lowering the reserve ratio decreases the

required reserves and expands excess reserves.

b. Gain in excess reserves increases banks’ lending

ability and, therefore, INCREASES the potential money supply

by a multiple amount of the increase in excess reserves.

3. EXAMPLE: What happens if the fed lowers the RR from

20% to 10% ?

Initially assume

- RR = 20%

- and the banking system has the following balance

sheet

|

Balance Sheet of the Banking

System

|

|

ASSETS

|

|

||

|

LIABILITIES

|

|

|

|

|

|

|

|

|

Reserves

|

$ 25,000

|

||

|

Demand Deposits

|

$ 100,000

|

|

Loans

|

$30,000

|

||

|

|

|

|

|

Securities

|

$ 45,000

|

||

|

|

|

|

|

What is the potential  MS?

MS?

Formulas:

MS

= initial ER x money multiplier (always

start with this formula)

MS

= initial ER x money multiplier (always

start with this formula)- ER = Total Reserves - Required

Reserves

- money multiplier = 1/RR

- Required Reserves = RR x Liabilities

Solution:

- Required Reserves = RR x Liabilities = .2

x $ 100,000 = $ 20,000

- ER = Total Reserves - Required

Reserves = $25,000 - $ 20,000 = $

5,000

- money multiplier = 1 / RR = 1/0.2 =

5

MS

= initial ER x money multiplier =

$ 5,000 x 5 = $ 25,000

MS

= initial ER x money multiplier =

$ 5,000 x 5 = $ 25,000

ANSWER: MS can increase by $ 25,000

What happens if the Fed LOWERS the DR to 10%?

Now:

- RR = 10%

- initially the banking system has the following

balance sheet

|

Balance Sheet of the Banking

System

|

|

ASSETS

|

|

||

|

LIABILITIES

|

|

|

|

|

|

|

|

|

Reserves

|

$ 25,000

|

||

|

Demand Deposits

|

$ 100,000

|

|

Loans

|

$30,000

|

||

|

|

|

|

|

Securities

|

$ 45,000

|

||

|

|

|

|

|

What is the potential

MS?

MS?

Formulas:

MS

= initial ER x money multiplier

MS

= initial ER x money multiplier- ER = Total Reserves - Required

Reserves

- money multiplier = 1/RR

- Required Reserves = RR x

Liabilities

Solution:

- Required Reserves = RR x Liabilities =

.1 x $ 100,000 = $ 10,000

- ER = Total Reserves - Required

Reserves = $25,000 - $ 10,000

= $ 15,000

- money multiplier = 1 / RR = 1/0.1

= 10

MS

= initial ER x money multiplier =

$ 15,000 x 10 = $ 150,000

MS

= initial ER x money multiplier =

$ 15,000 x 10 = $ 150,000

ANSWER: MS can increase by $ 150,000

4. Changing the reserve ratio has two effects:

a. It affects the size of excess reserves.

b. It also changes the size of the monetary

multiplier. For example, if ratio is lowered from 20 percent

to 10 percent, the multiplier increases from 5 to

10.

5. Changing the reserve ratio is very powerful

since it affects banks’ lending ability immediately. It

could create instability, so Fed rarely changes it.

6. Table 16-2 provides illustrations.

|

Three tools of the fed:

1. OMO

2. RR

3. DR

|

D. Discount Rate

1. Definition: the interest rate that the Fed charges

to commercial banks that borrow from the Fed.

2. An increase in the discount rate signals that

borrowing reserves is more difficult and will tend to shrink

excess reserves.

3. A decrease in the discount rate signals that

borrowing reserves will be easier and will tend to expand

excess reserves.

IV. Monetary Policy and the Monetary Policy Cause Effect Chain

(graphs)

A. "Easy" or expansionary monetary policy

1. occurs when the Fed tries to increase money supply

by expanding excess reserves in order to stimulate the economy.

2. GOAL: to reduce unemployment

3. The Fed will enact one or more of the following

measures.

a. The Fed will buy securities.

b. The Fed may reduce reserve ratio, although this

is rarely changed because of its powerful impact.

c. The Fed could reduce the discount rate,

although this has little direct impact on the money

supply.

d. The Fed could auction more reserves through the

term auction facility

4. Expansionary or easy money policy: The Fed takes steps to

increase excess reserves, banks can make more loans increasing

the money supply, which lowers the interest rate and increases

investment which, in turn, increases GDP by a multiple

amount of the change in investment.

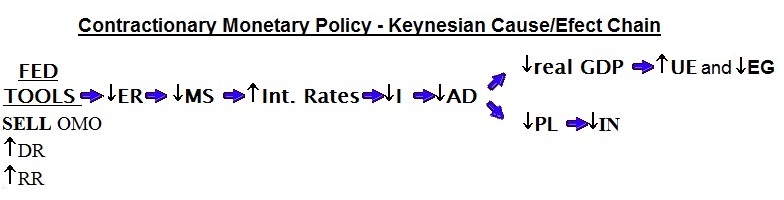

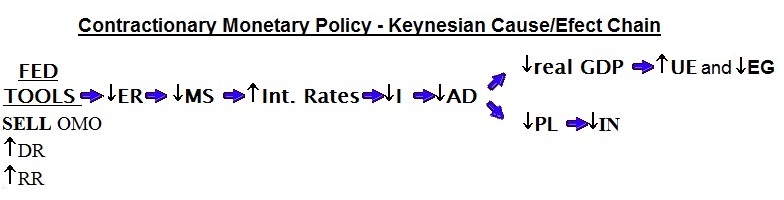

B. "Tight" or contractionary monetary policy

1. occurs when Fed tries to decrease money supply by

decreasing excess reserves in order to slow spending in the

economy during an inflationary period.

2. GOAL: to reduce inflation

3. The Fed will enact one or more of the following

policies:

a. The Fed will sell securities.

b. The Fed may raise the reserve ratio, although

this is rarely changed because of its powerful impact.

c. The Fed could raise the discount rate, although

it has little direct impact on money supply

d. Auction Fewer Reserves.

4. Contractionary or tight money policy is the reverse of an

easy policy: Excess reserves fall, the money supply decreases,

which raises interest rate, which decreases investment, which,

in turn, decreases GDP by a multiple amount of the change in

investment.

C. Textbook Graph (figure 16.5)

1. Using the textbook's "Key Graph 16.5",

how would we illustrate expansionary MP?

a. If the MS is Sm1 in graph

1

- so the equilibrium interest rate is 10%

(graph

1)

- with a 10% interest rate the initial amount of

investment is $15 billion (graph

2)

- with I = $15 billion the initial AD is AD1

(graph

3)

b. Fed either:

- buys securities

- lowers the DR

- lowers the RR

- auction more reserves

c. this increases ER and increases the MS from Sm1 to

Sm2 (graph

1)

d. interest rates fall from 10% to 8% (graph

1)

e. when interest rates fall, the amount of I increases

from $15 billion to $20 billion (graph

2)

f. this $5 billion increase in investment will

increase AD from AD1 to AD2 (graph

3)

g. THEREFORE, real GDP increases from Q1 to Qf

h. Review chapter 10 - Multiplier Effect.

- if Q1 = $400 billion

- and if MPC = 0.8

- what is Qf?

|

2. Using the textbook's "Key Graph 16.5", how would we

illustrate contractionary MP?

a. If the MS is Sm3 in graph

1

- so the equilibrium interest rate is 6%

(graph

1)

- with a 10% interest rate the initial amount of

investment is $25 billion (graph

2)

- with I = $25 billion the initial AD is AD3

(graph

3)

b. Fed either:

- sells securities

- raises the DR

- raises the RR

- auction fewer reserves

c. this decreases ER and decreases the MS from Sm3 to

Sm2 (graph

1)

d. interest rates rise from 6% to 8% (graph

1)

e. when interest rates rise, the amount of I decreases

from $25 billion to $20 billion (graph

2)

f. this $5 billion decrease in investment will

decrease AD from AD3 to AD2 (graph

3)

g. THEREFORE, real GDP decreases from Q3 to Qf

h. Review chapter 10 - Multiplier Effect.

- if Q1 = $450 billion

- and if MPC = 0.8

- what is Qf?

|

D. For several reasons, open-market operations give

the Fed most control of the four "tools."

1. Open-market operations are most important.

- This decision is flexible because securities can be

bought or sold quickly and in great quantities.

- Reserves change quickly in response.

2. The reserve ratio is rarely changed since this could

destabilize bank’s lending and profit positions.

3. Changing the discount rate has little direct effect,

- since only 2-3 percent of bank reserves are borrowed

from Fed.

- At best it has an "announcement effect" that signals

direction of monetary policy.

E. SUMMARY: Monetary Policies for Recession and Inflation --

TABLE 16.3

E. Quick

Quiz.

16b Other Macro Issues, Models

|

V. Effectiveness of Monetary Policy

A. Changes in the price level changes the

effectiveness of monetary policy

1. Easy monetary policy may be inflationary if

initial equilibrium is at or near full-employment. (AD3 to

AD4)

2. If economy is below full-employment, easy

monetary policy can shift aggregate demand and GDP toward

full-employment equilibrium. with little effect on inflation

(AD1 to AD2)

3. A tight monetary policy can reduce inflation with

little effect on unemployment if economy is near or above

full-employment (AD6 to AD5)

4. A tight monetary policy can make unemployment worse in

a recession. (AD2 to AD1)

B. Strengths of Monetary Policy

1. It is speedier and more flexible than fiscal

policy since the Fed can buy and sell securities daily.

2. It is less political. Fed Board members are isolated

from political pressure, since they serve 14-year terms, and

policy changes are more subtle and not noticed as much as

fiscal policy changes. It is easier to make good, but unpopular

decisions.

C. Focus on the Federal Funds Rate.

1. Currently the Fed communicates changes in

monetary policy through changes in its target for the Federal

funds rate.

2. Definition

- The Fed Funds rate is the interest rate that banks

pay other banks for overnight loans

- some banks may have ER left over at the end of the

day on reserve at the Fed

- other banks may not have enough reserves to meet

their required reserves

3. The Fed does not set either the Federal funds rate or

the prime rate; each is established by the interaction of

lenders and borrowers, but rates generally follow the Fed funds

rate.

4. The Fed acts through open market operations, selling

bonds to raise interest rates and buying bonds to lower

interest rates

D. Recent monetary policy.

1. Easy money policy in the early 1990s helped

produce a recovery from the 1990-1991 recession and the

expansion that lasted until 2001.

2. Tightening in 1994, 1995, and 1997 helped ease

inflationary pressure during the expansion.

2. To counter the recession that began in March 2001, the

Fed pursued an easy money policy that saw the prime interest

rate fall from 9.5 percent at the end of 2000 to 4.25 percent

in December 2002.

4. The Fed has been praised for helping the U.S. economy

maintain simultaneously full employment, price stability, and

economic growth for over four years.

5. They have also received credit for swift and strong

responses to the September 11, 2001, terrorist attacks,

significant declines in the stock market

E. Problems and Complications

1. Recognition and operational lags impair the

Fed's ability to quickly recognize the need for policy change

and to affect that change in a timely fashion.

- Although policy changes can be implemented rapidly

(short administrative lag), there is a lag of at least 3 to

6 months before the changes will have their full

impact.

- Lags:

1. RECOGNITION LAG is the

elapsed time between the beginning of recession or inflation

and awareness of this occurrence.

2. ADMINISTRATIVE LAG is

the difficulty in changing policy once the problem has been

recognized.

3. OPERATIONAL LAG is the

time elapsed between change in policy and its impact on the

economy. stimulating the economy from

recession.

2. CYCLICAL ASYMMETRY may exist: a tight monetary policy

works effectively to brake inflation, but an easy monetary

policy is not always as effective in

- Japan's ineffective easy money policy illustrates the

potential inability of monetary policy to bring an economy

out of recession. While pulling on a string (tight money

policy) is likely to move the attached object to its desired

destination, pushing on a string is not.

3. CHANGES IN VELOCITY: The velocity of money (number of

times the average dollar is spent in a year) may be

unpredictable, especially in the short run and can offset the

desired impact of changes in money supply. Tight money policy

may cause people to spend faster; velocity rises.

4. The IMPACT ON INVESTMENT may be less than

traditionally thought. Japan provides a case example. Despite

interest rates of zero, investment spending remained low during

the recession.

Also see: http://money.cnn.com/2003/06/11/news/economy/borrowing_slump/index.htm

F. Currently the Fed communicates changes in monetary policy

through changes in its target for the Federal funds rate. (Key

Question 5)

1. The Fed does not set either the Federal funds rate

or the prime rate; each is established by the interaction of

lenders and borrowers, but rates generally follow the Fed funds

rate.

2. The Fed acts through open market operations, selling

bonds to raise interest rates and buying bonds to lower

interest rates.

II. What Causes Macro Instability such as Great

Depression, Recessions, Inflationary Periods?

A. Mainstream View: This term is used to characterize

the prevailing perspective of most economists.

1. Mainstream macroeconomics is Keynesian-based,

and focuses on aggregate demand and its components. C(a) + I(g)

+ X(n) + G = GDP (Aggregate expenditures) = (real output)

2. Any change in one of the spending components in the

aggregate expenditure equation shifts the aggregate demand

curve. This, in turn, changes equilibrium real output, the

price level or both.

a. Investment spending is particularly subject

to variation.

b. Instability can also arise from the supply side.

Artificial supply restriction, wars, or increased costs of

production can decrease supply, destabilizing the economy by

simultaneously causing cost-push inflation and

recession.

B. Monetarist View: This label is applied to a modern form

of classical economics.

1. Money supply is the focus of monetarist

theory.

2. Monetarism argues that the price and wage flexibility

provided by competitive markets cause fluctuations in product

and resource prices, rather than output and employment.

3. Therefore, a competitive market system would provide

substantial macroeconomic stability if there were no government

interference in the economy.

a .It is government that has caused downward

inflexibility through the minimum wage law, pro union

legislation, and guaranteed prices for some products as in

agriculture.

b. Monetarists say that government also contributes to

the economy's business cycles through clumsy, mistaken,

monetary policies.

4. The fundamental equation of monetarism is the equation

of exchange. MV = PQ

a. The left side, MV, represents the total

amount spent [M, the money supply x V, the velocity of

money, (the number of times per year the average dollar is

spent on final goods and services)]

b. The right side, PQ, equals the nation's nominal GDP

[P is the price level or more specifically, the average

price at which each unit of output is sold x Q is the

physical volume of all goods and services produced (real

output)].

c. Monetarists say that velocity, V, is stable, meaning

that the factors altering velocity change gradually and

predictably. People and firms have a stable pattern to holding

money.

d. If velocity is stable, the equation of exchange

suggests there is a predictable relationship between the money

supply and nominal GDP (PxQ).

5. Monetarists say that inappropriate monetary policy is

the single most important cause of macroeconomic instability.

An increase in money supply will directly increase aggregate

demand, causing inflation during periods of

full-employment.

6. Mainstream economists view instability of investment

as the main cause of the economy's instability. They see

monetary policy as a stabilizing factor since it can adjust

interest rates to keep investment and aggregate demand

stable.

C. Consider This…Too Much Money?

1. Mainstream view argues the recession of 2007 - 2008

was caused by AD shocks due to the financial crisis which

decreased investment and consumption spending.

2. Monetarists argue the recession was caused by too much

money which contributed to low interest rates and led to the

housing bubble. The bursting of the housing bubble decreased

AD.

3. Most economists agree that the housing bubble led to the

recession, but many factors contributed to the housing bubble like

loose monetary policy, foreign savings into the U.S., "pass the

risk" lending practices, etc.

III. Does the Economy "Self-Correct"?

A. New Classical View of Self-Correction

1. Monetarist and rational expectation economists

believe that the economy has automatic, internal mechanisms for

self correction.

2. the adjustment process, which retains full employment

output according to this view.

3. The disagreement among new classical economists is

over the speed of the adjustment process.

a. Monetarists usually hold the adaptive

expectations view of gradual change. The supply curve shifts

may take 2 or 3 years or longer.

b. Rational expectations theory (RET) holds that

people anticipate some future outcomes before they occur,

making change very quick, even instantaneous.

i. Where there is adequate information,

people's beliefs about future outcomes accurately reflect

the likelihood that those outcomes will occur.

ii. RET assumes that new information about events

with known outcomes will be assimilated quickly.

4. In RET unanticipated price level changes do cause

temporary changes in real output. Firms mistakenly adjust their

production levels in response to what they perceive to be a

relative price change in their product alone. Any change in GDP

is corrected as prices are flexible and firms readjust output

to its previous level.

5. In RET fully anticipated price level changes do not

change real output, even for short periods. Firms are able to

maintain profit and production levels.

B. Mainstream View of Self Correction

1. There is ample evidence that many prices and

wages are inflexible downward for long periods of time.

However, some aspects of RET have been incorporated into the

more rigorous model of the mainstream.

2. the adjustment process along a horizontal aggregate

supply curve.

3. Downward wage inflexibility may occur because firms

are unable to cut wages due to contracts and the legal minimum

wage. Firms may not want to reduce wages if they fear problems

with morale effort, and efficiency.

4. An efficiency wage is one that minimizes the firm's

labor cost per unit of output. Firms may discover that paying

higher than market wages lowers wage cost per unit of output.

a. Workers have an incentive to retain an above

market wage job and may put forth greater work effort.

b. Lower supervision costs prevail if workers have

more incentive to work hard.

c. An above market wage reduces job turnover.

5. Some economists believe wages don't fall easily

because already employed workers (insiders) keep their jobs

even though unemployed outsiders might accept lower pay.

Employers prefer a stable work force.

IV. Rules or Discretion?

A. Monetarists and other new classical economists believe that

policy rules would reduce instability in the economy.

1. A monetary rule would direct the Fed to

expand the money supply each year at the same annual rate as

the typical growth of GDP.

a. The rule would tie increases in the money

supply to the typical rightward shift of long run aggregate

supply, and ensure that aggregate demand shifts rightward

along with it.

b. A monetary rule, then, would promote steady growth

of real output along with price stability.

2. A few economists favor a constitutional amendment to

require the federal government to balance its budget

annually.

a. Others simply suggest that government be

"passive" in its fiscal policy and not intentionally create

budget deficits of surpluses.

b. Monetarists and new classical economists believe

that fiscal policy is ineffective. Expansionary policy is

bad because it crowds out private investment.

c. RET economists reject discretionary fiscal policy

for the same reason they reject active monetary policy. They

don't believe it works because the effects are fully

anticipated by private sector.

B. Mainstream economists defend discretionary stabilization

policy.

1. In supporting discretionary monetary policy,

mainstream economists argue that the velocity of money is more

variable and unpredictable, in short run monetary policy can

help offset changes in AD than monetarists contend.

2. Mainstream economists oppose requirements to balance

the budget annually because it would require actions that would

intensify the business cycle, such as raising taxes and cutting

spending during recession and the opposite during booms. They

support discretionary fiscal policy to combat recession or

inflation even if it causes a deficit or surplus

budget.

C. The U.S. economy has been about one third more stable

since 1946 than in earlier periods. Discretionary fiscal and

monetary policies were used during this period and not before.

This makes a strong case for its success.

D. A summary of alternative views presents the central ideas

and policy implications of four main macroeconomic theories:

Mainstream macroeconomics, monetarism, rational expectations

theory and supply side economics. (See Table 36.1)

E. CONSIDER THIS … On the Road Again

Keynesian Abba Lerner compared the economy to a car without

a steering wheel, and that the prudent addition and use of a

steering wheel (discretionary fiscal and monetary policy) would

stabilize the macroeconomy. Monetarist Milton Friedman argued that

the steering wheel already exists, and that discretionary use of

monetary policy by the Fed keeps jerking on it, causing the car

(the macroeconomy) to swerve. If the Fed would just hold the

steering wheel steady, the macroeconomy would be stable.

|

OPTIONAL

G. Monetary policy and the international

economy:

1. Net export effect occurs when foreign

financial investors respond to a change in interest

rates.

a. Tight monetary policy and higher

interest rates

1) lead to appreciation of dollar value

in foreign exchange markets;

2) When dollar appreciates, American goods

become more costly to foreigners, and this

lowers demand for U.S. exports, which tends to

lower GDP.

3). This is the desired effect of a tight

money policy.

b. an easy money policy and lower interest

rates

1) leads to depreciation of dollar,

2) greater demand for U.S. exports and higher

GDP.

3). This policy has the desired outcome for

expanding GDP.

2. Summary

3. FP vs. MP and the international

economy

a Expansionary FP:

1) goal to increase AD and reduce

UE

2) net export effect

- gov't borrowing can cause

higher

interest rates, which causes

- greater

demand for the dollar by foreigners, which

causes

- the

DOLLAR to APPRECIATE, which

causes

- US

imports to increase and US exports to

decrease, which

- will

DECREASE AD and

- REDUCES

THE EFFECTIVENESS of the expansionary FP

(SMALLER MULTIPLIER)

b. Easy MP:

1) goal to increase AD and reduce

UE

2) with the international economy

- increasing

the MS causes lower interest rates, which

causes

- less

demand for the dollar by foreigners, which

causes

- the

DOLLAR to DEPRECIATE, which

causes

- US

imports to decrease and US exports to

increase, which

- will

INCREASE AD

- INCREASES

THE EFFECTIVENESS of the easy MP.

|