|

We now begin unit 3 where we focus on

macroeconomic POLICY. When we say "policy" we mean

"government". What can the government do to achieve the

three macroeconomic goals of low UE, low IN, and rapid EG?

In lesson 12c we introduced stabilization policies: monetary

policy and fiscal policy. (This would be a good time to

review your notes on lesson 12c.) Here, we will dig deeper,

beginning with Monetary Policy (MP).

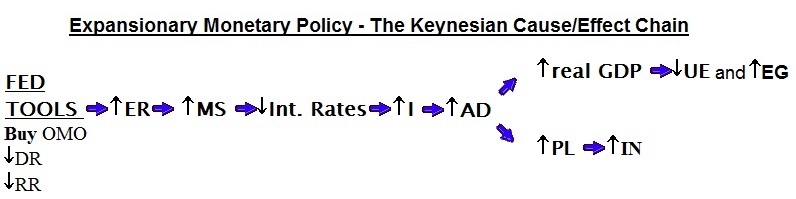

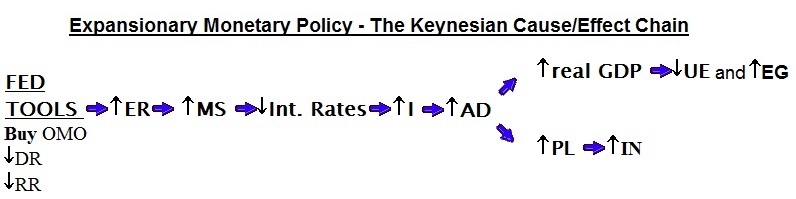

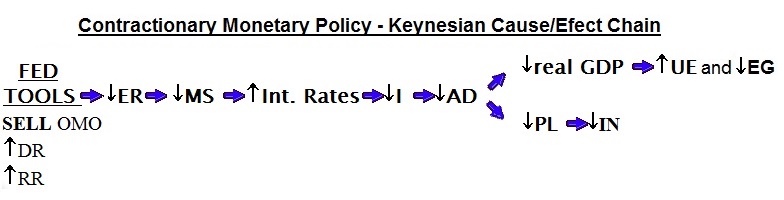

In lesson 12 c we learned that if UE

is high we can increase the money supply (MS) which will

cause interest rates to go down. We called this an "Easy

Money Policy". Lower interest rates will increase investment

(I) and therefore increase aggregate demand (AD). When AD

increases it will increase real domestic output (RDO or real

GDP) and decrease UE. But, it may increase the price level

(PL) and therefore increase inflation.

We begin monetary policy in lesson

14a by defining money (what is money?) and the money supply

(MS). Then we will develop the model (graphs) of the money

market that we will use in the next three chapters to show

how monetary policy works. We finish the lesson with a

discussion of the structure of the Federal Reserve (the

Fed). As we know from lesson 12a the Fed controls the money

supply (MS). Here we learn that "the Fed" is NOT the

federal government in Washington DC.

The policy making arm of the Fed is

basically the Federal Open Market Committee (FOMC) comprised

of 12 people and these 12 people have the power to raise

interest rates and put millions of people of work as they

did in the early 1980s. Or, the FOMC can lower interest

rates causing millions of people to earn less on their

financial investments. The chairperson of the Fed (Jerome

Powell in 2018) has been called "the second most powerful

person in the United States". In this unit we will learn

why.

|