Chapter 7 - Measuring Domestic Output and National

Income

Measuring the Economy

|

What you need to know:

- Define GDP.

- Why is GDP a "monetary measure"?

- What are "double counting", "intermediate goods",

and "final goods"?

- What is included in GDP and what is excluded?

- How to calculate GDP using the expenditures

approach.

- How to calculate net exports (Xn)

- What is included in Gross Private Domestic

Investment (Ig)

- Define and calculate Net Private Domestic

Investment (In)

- What it means when Net Private Domestic Investment

is positive, zero, and negative.

- How to calculate National Income

|

NI = Wages + Rents + Interest +

Corp. Profits + Prop. Income

|

- Define and calculate Net Domestic Product (NDP)

|

NDP = GDP - depreciation

NDP - C + In + G +

Xn

|

- Define National Income (NI)

- Define Personal Income (PI)

- Define Disposable Income ((DI)

- Define nominal GDP

- Define and calculate real GDP

|

real GDP = nominal GDP / (GDP

Price Index/100)

|

- Know the problems (shortcomings) of using GDP as a

measure of social welfare (how well the economy is

doing) and whether, because of them, GDP tends to

OVERstate or UNDERstate social welfare

|

Introduction

We've been using the AS - AD model to understand the

macroeconomy. The vertical axis measures the PRICE LEVEL which is

the average level of prices in an economy. The horizontal axis

measures REAL DOMESTIC OUTPUT which is all the goods and services

produced in an economy.

But WHAT NUMBERS do we put on the axes? How do we measure the

price level and real domestic output?

We measure real domestic output with REAL GDP and we measure

the price level with a PRICE INDEX.

In this lesson we'll learn how to calculate real GDP and a

price index.

Measuring Real Domestic Output: real GDP

We will use "real GDP" to measure real domestic output - the

total amount of output produced in an economy . The table below

lists the GDP for a few countries.

|

NOTE: 2007 data

|

Populations:

- US: 303 million

- Japan: 128 million

- Germany: 82 million

- China: 1,324 million

- UK: 60 million

- France: 61 million

- Italy: 59 million

- Canada: 32 million

- Brazil: 192 million

- India: 1,158 million

- S. Korea: 48 million

- Mexico: 112 million

- Australia: 20 million

|

Note, that if you wish to COMPARE countries you should use GDP PER

CAPITA which is GDP divided by the country's population (GDP per

person). Even though the United States has the world's largest GDP,

it is not the highest GDP per capita. For a table of GDP per capita

see: http://www.nationmaster.com/graph/eco_gdp_percap-economy-gdp-per-capita

Definition: GDP

Gross Domestic Product is the

total market value of

all final goods and

services that

are produced in the

economy in one year.

This is one definition that should be memorized. As you can see

it has three components.

(1) "total market

value"

How can we add the number of buildings produced to

the number of candy bars produced to the number of cars

produced, etc.? To do this we need a common unit of measure.

The unit of measure for real domestic output or real GDP is

the market value or money

To get the "total" market value then one would think that

you would add up the price times the quantity of everything

produced:

GDP = SUM P x Q

GDP =  P this year x

Q this year

P this year x

Q this year

GDP equals the sum of the prices times quantities of

everything produced in a year

This, then, would give you the total market value of

everything produced.

(2) "final goods and

services"

Only final goods and services are included to avoid

double counting

Final goods are bought and used by the

final consumer. When you buy a hamburger from McDonald's

the value of the hamburger should be included in GDP

because it is a final good.

Intermediate goods are bought so that they can

be resold or further processed. When McDonald's buys

buns, ground beef, and ketchup, the value of these

purchases of intermediate goods are NOT added to GDP

since they will be added when a consumer buys the

hamburger (a final good).

If we included the price of the hamburger AND the

value of the bun, ground beef, and ketchup then these

would be counted twice.

Another way to avoid double counting is to use the

value-added method and only add what McDonald's spends on

buns, ground beef, and ketchup, but then NOT include what

consumers spend on the hamburger.

The point is we want to get a measure of the market value

of the final goods that an economy produces.

(3) "produced in one

year"

GDP is a measure of what is produced or made in one

year, therefore:

a. secondhand sales are not included because

nothing new is produced, and

b. financial transactions not included because nothing is

produced

A car produced in 1999 is included in 1999's GDP.

Therefore, if a used 1999 vehicle is sold in the year 2001

we would NOT again include its price in the GDP for 2001

since it was not produced then. We WOULD include the profits

earned by the used car salesperson in 2001 since he or she

did clean, advertise, and sell the used car in that year,

but we would not include the value of the 1999 car

itself.

Also, a lot of the "business news" that you hear

concerning the billions of dollars spent on stocks and bonds

each day does not affect the GDP directly.

When people buy stocks and bonds from whom do they buy

them? If I buy $100 of stock in IBM, from whom do I buy it?

I may buy it through a stock broker, but whose stock do I

buy? I probably didn't buy it from IBM (unless it was an IPO

- Initial Public Offering), but rather I bought it from

somebody who had bought it earlier. In other words, I bought

"used" stock. But the main point is, when I buy $100 on IBM

stock, nothing is being produced so the $100 is not added to

GDP.

|

REVIEW: (Textbook Question

7-13)

Which of the following are actually included

in this year’s GDP? Explain your answer in

each case.

a. Interest on an AT&T corporate

bond.

b. Social security payments

received by a retired factory worker.

c. The unpaid services of a

family member in painting the family home.

d. The income of a

dentist.

e. The money received by Smith

when she sells her economics textbook back to

the bookstore.

f. The monthly allowance a

college student receives from home.

g. Rent received on a

two-bedroom apartment.

h. The money received by Josh

when he resells his current-year-model Honda

automobile to Kim.

i. The publication of a

college textbook.

j. A 2-hour decrease in the

length of the workweek.

k. The purchase of an AT&T

corporate bond.

l. A $2 billion increase in

business inventories.

m. The purchase of 100 shares

of GM common stock.

n. The purchase of an

insurance policy.

ANSWERS

are at the bottom of this webpage.

|

Circular Flow Model

The circular flow model can help us to understand the two

approaches used to measure GDP.

1. expenditures approach

2. income approach

Arrow # 3 is real GDP (goods and services produced). This is

output produced by business and sold in the product markets to

consumers (households). This is what we want to measure. This is real

domestic output. This is GDP.

To measure this level of produced output we can measure arrow #4

which are the expenditures spent on this output. This is the

EXPENDITURES APPROACH. If something is produced and sold the amount

sold should equal the amount produced. The only problem with this is

what happens if something is produced one year but not sold in the

next year? If we just added up the market values of goods and

services that were sold these items would be included in the wrong

year. To handle this problem we include items produced one year and

sold the next as changes in business inventories which ARE included

the year that they are produced.

We can also measure arrow #1 which is the income earned by

households when they sell their resources (arrow #2) to businesses.

The value of output produced (GDP) is equal to the value of ALL the

income earned by everyone who had anything to do with producing the

output. If a $20,000 car is sold, then $20,000 was earned by everyone

who was involved in producing and selling the car. So to measure GDP

( the value of the products produced) we can sum up all the income

earned in producing that level of GDP. This is the INCOME APPROACH to

calculating GDP.

Expenditures Approach

KNOW THIS !

GDP = C + Ig + G + Xn

1. personal consumption expenditures (C) includes durable

goods (lasting 3 years or more), nondurable goods and services.

2. gross private domestic investment (Ig)

Remember that we defined investment as the "accumulation of

capital" and we defined capital as "manufactured resources" so

investment occurs when businesses buy capital. If a carpenter buys

a hammer it is an investment. (Note: if an economist buys 100

shares of stock in Microsoft, it is NOT an economic

investment.)

[Noninvestment transactions - despite how the term

"investment" is used by the general public, investment does not

include transfers of ownership of paper assets (stocks and bonds)

or real assets (houses, jewelry, art). Only newly created capital

is counted as investment.]

Economic Investment includes:

1) all final purchases of machinery, equipment, and

tools by businesses

2) all construction (including homes)

3) changes in inventories (To include items produced one year

but sold the next. If businesses are able to sell more than

they currently produce, this entry will be a negative number. )

gross vs. net domestic investment (In)

Gross investment is ALL NEW INVESTMENT and includes

the three items listed above.

Net investment includes only the CHANGES to the nation's

capital stock

Each year as new goods and services are being produced, some

of the existing capital equipment is wearing out and buildings

are deteriorating. This is called "depreciation" or

"consumption of fixed capital". Whereas gross investment adds

to a country's stock of capital, depreciation reduces a

country's stock of capital.

Net investment = Gross Investment - depreciation

In = Ig - depreciation

Net investment is related to economic growth.

If net investment is positive then the country ends up

with more capital at the end of the year than it stated

with. Since we know that economic growth is caused by

getting "more resources", if net investment is positive then

the economy is growing, ("expanding economy").

What type of economic growth is this (1)

increasing our potential from the 5Es or, (2) achieving

our potential (or achieving full employment)?

It would be "increasing our potential" which is caused

by getting more resources, better resources, and better

technology.

If net investment is negative this means that

depreciation is greater than gross investment, or more

capital wears out than is produced so we would have a

"declining economy".

If gross investment (all new capital that is produced)

EQUALS depreciation (capital that wears out) then net

investment will equal zero. there will be no changes to

amount of capital that a country has, and there will be a

"static economy".

3. government purchases (G)

This includes purchases by all levels of government

(federal, state and local). Whenever the government buys

something or pays somebody it is included in government

purchases.

Government purchases does NOT include transfer payments.

Transfer payments, by definition, are payments for which

nothing is expected in return. Government transfer payments

include welfare and social security payments, transfers from

the federal government to state government and from state to

local governments. These are not included in GDP as government

purchases because when the government transfers money, NOTHING

IS PRODUCED and GDP only includes production. Of course, when

people on welfare spend their government check on food and rent

then this does enter GDP as consumption (C).

4. net exports (Xn)

Net exports (Xn) included the value of all exports

from a country minus the value of all imports.

Xn = X - M

If a country has a trade deficit then the value of imports

is greater than the value of a country's exports and net

exports (Xn) is negative.

It should be obvious why exports is included in GDP and it

should be obvious why imports should NOT be added to GDP. But

why do we have to SUBTRACT imports from GDP. Subtracting is a

lot different than not adding.

Imports are subtracted from GDP because they were

incorrectly included in consumption expenditures (C). Since

imports are produced in another country they should not be

added to our GDP, but they are added as art of of consumption

so therefore they have to be removed.

Practice Problem

Given the data below, use the EXPENDITURES APPROACH to

calculate GDP.

|

Use the data below to calculate the GDP of this

economy using the expenditures approach. All figures are

in billions.

|

Personal consumption expenditures

|

$400

|

|

Government purchases

|

128

|

|

Gross private domestic investment

|

88

|

|

Net exports

|

7

|

|

Net foreign factor income earned in the

U.S.

|

0

|

|

Consumption of fixed capital

|

43

|

|

Indirect business taxes

|

50

|

|

Compensation of employees

|

369

|

|

Rents

|

12

|

|

Interest

|

15

|

|

Proprietors' income

|

52

|

|

Corporate income taxes

|

36

|

|

Dividends

|

24

|

|

Undistributed corporate profits

|

22

|

|

|

|

ANSWER: Before scrolling down, pick up some paper and a pencil

and actually calculate GDP. DOING it yourself is better than

reading it.

.

.

.

.

.

From the table we get:

|

GDP

|

=

|

C

|

+

|

I

|

+

|

G

|

+

|

Xn

|

|

GDP

|

=

|

400

|

+

|

128

|

+

|

88

|

+

|

7

|

GDP = C + I + G + Xn = 400 + 128 + 88 + 7 = $ 623

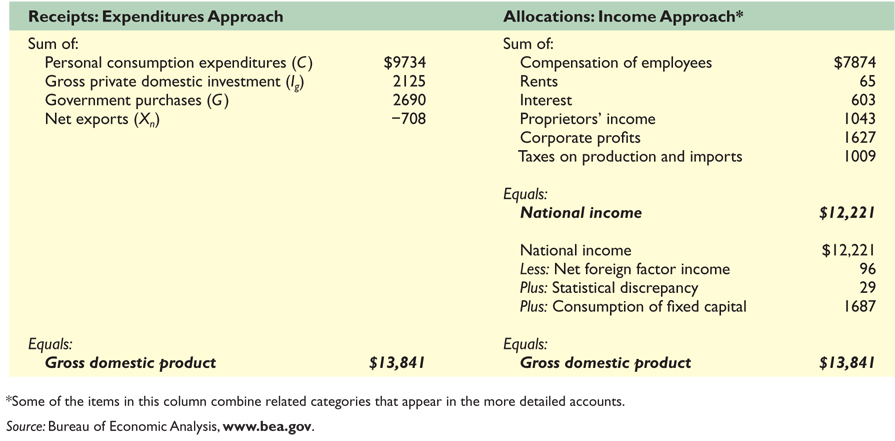

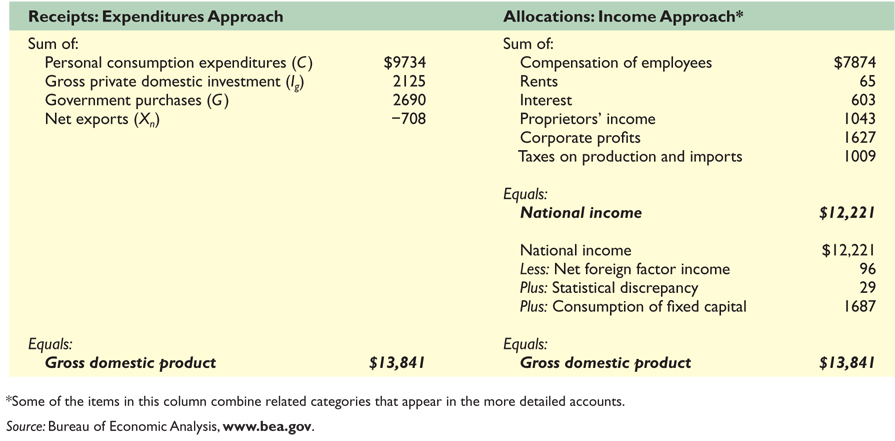

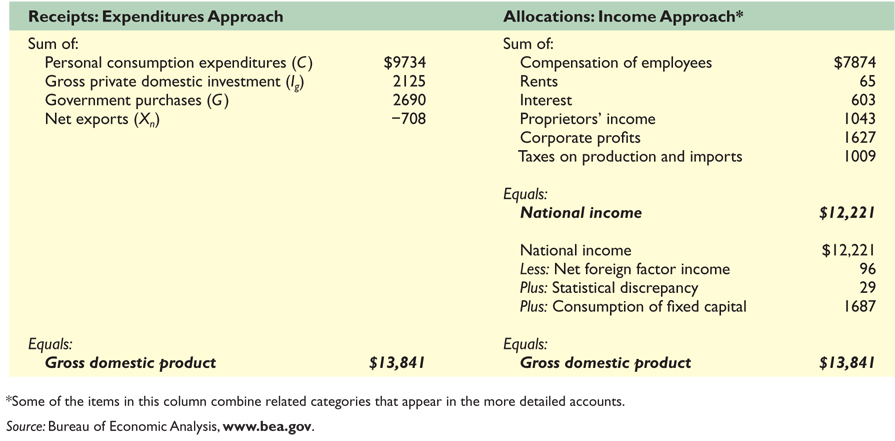

The Real World - the 2007 United States GDP:

Income Approach --calculating national income (NI)

A second way to calculate GDP is by adding up all INCOME

- flow #1 in the circular flow diagram below is the income

received when resources are sold to businesses.

There are four types of resources (four factors of

production):

- labor

- land

- capital

- entrepreneurial ability

Each of these resource types receives what economist call

INCOME when they are sold:

- labor receives wages

- land receives rent

- capital receives interest

- entrepreneurial ability receives profits

So if we add up:

wages + rent + interest + profits

we should get GDP -- well almost. Actually we get something

called National Income (NI), or the income EARNED by the

resources. the textbook goes through the calculation on how to get

from NI to GDP - but we won't have to do that in this course. What

we will do is divide the profits earned by entrepreneurs into two

types: proprietor's income and corporate profits. So:

|

NI = Wages + Rents + Interest + Corp. Profits

+ Prop. Income

|

[The new edition of our textbook now also adds

Taxes on production and imports including general sales taxes,

excise taxes, business property taxes, license fees, and

customs duties to the above to get NI -- we will not do this

either.]

Definitions:

national income: all income earned by American

supplied resources, whether here or abroad, plus taxes on

production and imports.

Compensation of employees includes wages, salaries,

fringe benefits, salary and supplements, and payments made on

behalf of workers like social security and other health and

pension plans.

Rents: payments for supplying property resources

(adjusted for depreciation it is net rent).

Interest: payments from private business to suppliers

of money capital.

Proprietors' income: income of incorporated

businesses, sole proprietorships, partnerships, and

cooperatives.

Corporate profits: After corporate income taxes are

paid to government, dividends are distributed to the

shareholders, and the remainder is left as undistributed

corporate profits (also referred to as retained earnings).

Practice Problem

Given the data below, use the INCOME APPROACH to calculate

National Income (NI).

|

Use the data below to calculate the GDP of this

economy using the income approach. All figures are in

billions.

|

Personal consumption expenditures

|

$400

|

|

Government purchases

|

128

|

|

Gross private domestic investment

|

88

|

|

Net exports

|

7

|

|

Net foreign factor income earned in the

U.S.

|

0

|

|

Consumption of fixed capital

|

43

|

|

Indirect business taxes

|

50

|

|

Compensation of employees

|

369

|

|

Rents

|

12

|

|

Interest

|

15

|

|

Proprietors' income

|

52

|

|

Corporate income taxes

|

36

|

|

Dividends

|

24

|

|

Undistributed corporate profits

|

22

|

|

|

|

ANSWER: Before scrolling down, pick up some paper and a pencil

and actually calculate GDP. DOING it yourself is better than

reading it.

.

.

.

|

NI = Wages + Rents + Interest + Corp.

Profits + Prop. Income

|

.

.

From the table we get:

|

NI

|

=

|

Wages

|

+

|

Rents

|

+

|

Interest

|

+

|

Corp. Profits

|

+

|

Proprietor's Income

|

|

NI

|

=

|

369

|

+

|

12

|

+

|

15

|

+

|

82

|

+

|

52

|

NI = Wages + Rents + Interest + Corp. Profits +

Prop. Income

Corporate profits are used for three different

purposes:

- Corporate income taxes = 36

- Dividends = 24

- Undistributed corporate profits = 22

Corporate profits then equal 36 + 24 + 22 = 82 . On the

exams I will give you "corporate profits".

NI = 369 + 12 + 15 + 82 + 52 = $ 530

GDP = C + I + G + Xn = 400 + 128 + 88 + 7 = $

623

As you can see, National income does not equal GDP. There

are some expenditures (that are included in the expenditures

approach) that are not income (therefore not included in the

income approach). They are indirect business taxes ( 50),

depreciation (43), and net foreign income factor ( 0 ), But,

again, you won't have to do this in this course.

Other Social Accounts

Net Domestic Product (NDP)

National Income (NI)

|

NI = Wages + Rents + Interest + Corporate

Profits + Proprietor's Income

|

NI is income EARNED by the factors of production

(resources).

Personal Income (PI)

PI is the income RECEIVED by the factors of

production (resources). To calculate, take NI minus payroll

taxes (social security contributions), minus corporate

profits taxes, minus undistributed corporate profits, and

add transfer payments.

Disposable Income (DI) is your SPENDABLE income. DI

is personal income minus personal taxes.

The Real World - the 2007 United States GDP:

REVIEW:

|

7-8 (Key Question) Below is a list of domestic

output and national income figures for a given year. All

figures are in billions. The ensuing questions ask you to

determine the major national income measures by both the

expenditure and income methods. Answers derived by each

approach should be the same.

a. Using the above data, determine GDP and

NDP by the expenditure method.

b. Calculate National Income (NI) by the income

method.

|

Personal consumption

expenditures..............

Net foreign factor income earned

Transfer payments...........................

Rents

Consumption of fixed capital

(depreciation).......

Social security contributions

Interest.......

Proprietors’ income

Net

exports..........................................

Dividends (part of corporate profits)

Compensation of employees.............

Indirect business taxes

Undistributed corporate profits (part of

profits)....

Personal taxes

Corporate income taxes (part of corporate

profits)....

Corporate profits

Government purchases........

Net private domestic investment

Personal saving.......

|

....$245

4

....12

14

....27

20

....13

33

.....11

16

....223

18

....21

26

....19

56

......72

33

.......20

|

ANSWERS:

a. Using the above data, determine GDP and

NDP by the expenditure method.

GDP = $388

GDP = C + Igross + G + Xn

Igross = Inet + depreciation = 33 + 27 = 60

GDP = 245 + 60 + 72 + 11 = 388

NDP = $361

NDP + C + Inet + G + Xn

NDP = 245 + 33 + 72 + 11 = 361

or

NDP = GDP - depreciation

NDP = 388 - 27 = 361

b. Calculate National Income (NI) by the income

method.

NI = $339

NI = wages + rents + interest + profits

profits = corporate profits + proprietor's

income

profits = 56 + 33 = 89

NI = 223 + 14 + 13 + 89 = 339

|

GDP and Economic Well-Being

GDP per capita is often used to measure a country's well being or

standard of living. The higher the GDP per capita for a country the

better off the country is. But there are some problems with using GDP

per capita to measure a country's standard of living.

Problems with using GDP to Measure the Standard of

Living:

1. non-market transactions are not included in GDP

2. leisure increases the standard of living but it isn't

counted

3. improved product quality often isn't accounted for in GDP

4. GDP does not account for the composition output

5. GDP does not account for the distribution of output

6. increases in GDP may harm the environment and decrease the

standard of living

7. the underground economy produces goods and services but they

are not included in GDP

8. GDP does not account for a possible future decline in output

due to resource depletion.

9. Noneconomic Sources of Well-Being like courtesy, crime

reduction, etc., are not covered in GDP.

10. We must use per capita GDP to compare the living

standards of different countries.

1. non-market transactions are not included in GDP

GDP doesn’t measure some very useful output

because it is unpaid (homemakers’ services, parental child

care, volunteer efforts, home improvement projects). Called

non-market transactions

2. leisure increases the standard of living but it isn't

counted

GDP doesn’t measure improved living conditions as

a result of more leisure.

3. improved product quality often isn't accounted for in

GDP

GDP doesn’t measure improvements in product

quality unless they are included in the price

4. GDP does not account for the composition of output

GDP makes no value adjustments for changes in the

composition of output. Nominal GDP simply adds the dollar

value of what is produced; it makes no difference if the

product is a semiautomatic rifle or a jar of baby food.

5. GDP does not account for the distribution of output

GDP makes no value adjustments for changes in the

distribution of income. Per capita GDP may give some hint

as to the relative standard of living in the economy; but GDP

figures do not provide information about how the income is

distributed.

6. increases in GDP may harm the environment and decrease the

standard of living

- The harmful effects of pollution are not deducted from GDP

(oil spills, increased incidence of cancer, destruction of

habitat for wildlife, the loss of a clear unobstructed

view).

- GDP does include payments made for cleaning up oil spills

and the cost of health care for cancer victims.

7. the underground economy produces goods and services but they

are not included in GDP

GDP does not include output from the Underground

Economy. Illegal activities are not counted in GDP

(estimated to be around 8% of U.S. GDP). Legal economic

activity may also be part of the “underground,”

usually in an effort to avoid taxation.

Illegal activities are not counted in GDP (estimated to be

around 8% of U.S. GDP).

Legal economic activity may also be part of the

"underground," usually in an effort to avoid taxation.

8. GDP does not account for a possible future decline in output

due to resource depletion.

9. Noneconomic Sources of Well-Being like courtesy, crime

reduction, etc., are not covered in GDP.

10. We must use per capita GDP to compare the living

standards of different countries.

Which country has a higher GDP, Switzerland or India?

Which has a higher level of economic well-being:

- Switzerland:

- GDP: $239.3 billion (2003 est.)

- Population: 7,450,867 (July 2004 est.)

- GDP per capita: $32,700 (2003 est.)

- India:

- GDP: $3.033 trillion (2003 est.)

- Population: 1,065,070,607 (July 2004 est.)

- GDP per capita: $2,900 (2003 est.)

GDP

per capita = GDP / population

REVIEW:

|

Do each of the following cause GDP to OVERSTATE the

economic well-being of a country or UNDERSTATE

it?

1. non-market transactions (Does GDP

OVERstate or UNDERstate economic well-being?)

not included so, GDP UNDERstates

well-being.

2. improved product quality (Does GDP

OVERstate or UNDERstate economic well-being?)

not accounted for, so GDP UNDERstates

well-being.

3. more leisure (Does GDP OVERstate or

UNDERstate economic well-being?)

not accounted for, so GDP UNDERstates

well-being.

4. the composition of output (Does GDP

OVERstate or UNDERstate economic well-being?)

if "bad" things are being produced, then

GDP OVERstates well-being.

5. the distribution of income (Does GDP

OVERstate or UNDERstate economic well-being?)

an unequal distribution of income would

result in GDP OVERstating the well-being of most of

a country's population

6. the underground economy (Does GDP

OVERstate or UNDERstate economic well-being?)

not accounted for, so GDP UNDERstates

well-being

7. GDP and the environment (Does GDP

OVERstate or UNDERstate economic well-being?)

harmful effects of pollution and costs of

pollution reduction are not deducted from GDP, so

GDP OVERstates well-being.

8. Non-economic sources of well-being (Does

GDP OVERstate or UNDERstate economic well-being?)

not accounted for, so GDP UNDERstates

well-being

9. Resource depletion (Does GDP OVERstate or

UNDERstate economic well-being?)

GDP overstates well-being since when we

are depleting the resources our GP is high, but in

a future with fewer resources GDP will be lower

10. per-capita income (Does GDP OVERstate or

UNDERstate economic well-being?)

GDP OVERstates well-being in countries

with large populations and UNDERstates well-being

in countries with small populations

|

Measuring the Price Level and real GDP

Introduction

We've been using the AS - AD model to understand the macroeconomy.

The vertical axis measures the PRICE LEVEL which is the average level

of prices in an economy. The horizontal axis measures REAL DOMESTIC

OUTPUT which is all the goods and services produced in an

economy.

But WHAT NUMBERS do we put on the axes? How do we measure the

price level and real domestic output?

We have seen that we measure real domestic output with REAL GDP

and we have learned how to calculate GDP. In the lecture

on unemployment and inflation we learned how a PRICE INDEX is

used to measure the price level. Now we will learn how to use a price

index to calculate REAL GDP.

Nominal GDP and real GDP

Nominal GDP is the market value of all final goods and

services produced in a year. Nominal GDP is a (P x Q) figure

including the quantity of every item produced in the economy in

one year times its price THAT year.

Nominal GDP is calculated using the current prices prevailing

when the output was produced but real GDP is a figure that has

been adjusted for price level changes.

Nominal GDP = SUM (this year's prices x this year's quantities)

=  (P this year x

Q this year)

(P this year x

Q this year)

Therefore, if nominal GDP increases is it because we are

producing more (  Q this year ) or is it because the

Price Level increased (

Q this year ) or is it because the

Price Level increased (  P this year) ?

P this year) ?

In fact it is possible for nominal GDP to increase even though

the quantity produced has DECREASED. How?

Nom. GDP =  (P this year x

Q this year)

(P this year x

Q this year)

IF prices increased a lot, nominal GDP would increase even if

the quantity produced went down.

(P this year

(P this year  x Q this year

x Q this year  )

=

)

= Nom. GDP

Nom. GDP

So if we know that nominal GDP has increased, we still do not

know if we are producing more (and reducing scarcity) or if the

price level has just increased.

Real GDP is a measure of how much was actually produced. That

is why it is used on the AS/AD graph as a measure of real domestic

output (RDO). We measure RDO with real GDP, not nominal GDP.

We calculate real GDP by summing the quantity produced of

everything in an economy times ITS PRICE IN A BASE YEAR. Since we

always use the same base year prices if the quantity produced

increases it will increase real GDP.

Real GDP = SUM (base year's prices x this

year's quantities) =  P base year x

Q this year

P base year x

Q this year

By using the same price level (base year prices) we remove the

effects of a higher price level (inflation) and if REAL GDP

increases we know that the economy is producing more and scarcity

is being reduced.

real GDP

- real GDP = SUM P base year x Q specific

year

- specific year's quantities x base years prices

|

Real GDP = SUM (base year's prices x this

year's quantities) =  P base year x

Q this year

P base year x

Q this year

By using the same price level (base year prices) we

remove the effects of a higher price level (inflation)

and if REAL GDP increases we know that the economy is

producing more and scarcity is being reduced.

|

Calculating a price index

To measure the price level we use a price index. A price index is

a measure of the price level as a percent of the price level in a

BASE year. This is different from inflation which is the rate of

increase in the price level from the PREVIOUS year.

As you have read, to calculate a price index a year is selected as

a base year. The average level of prices for that year is assigned a

value of 100. Then the price levels for all other years are

calculated as a percent of the base year.

GDP Price Index

definition

a price index is a measure of the price of a

specified collection of goods and services, called a "market

basket", in a given year as compared to the price of an

identical (or highly similar) collection of goods and

services in a reference year (called the "base year")

calculating a GDP price index

price index in a given year = (price of market

basket in a specific year / price of same market basket in

base year) x 100

calculating real GDP

real GDP = Nominal GDP / Price Index

Actually, you then need to multiply it by 100.

real GDP = (Nominal GDP / Price Index) x 100

|

The following data show nominal GDP and the

appropriate price index for several years.

Compute real GDP for each year. In which year(s) was

there a recession (decline in real GDP)?. All GDP are

in billions.

Nominal

Price level

Year

GDP

index

Real GDP

1

$117

120

___

2

124

104

___

3

143

85

___

4

149

96

___

5

178

112

___

6

220

143

___

The answers are below:

ANSWERS:

Nominal

Price level

Year

GDP

index

Real GDP

1

$117

120

$ 98

2

124

104

119

3

143

85

168

4

149

96

155

5

178

112

159

6

220

143

154

|

Textbook, questions 7-13 ANSWERS

(a) Interest on an AT&T bond. Included.

- Income received by the bondholder for the services derived by the

corporation for the loan of money.

(b) Social security payments received by a retired

factory worker. Excluded. - A transfer payment from taxpayers

for which no service is rendered (in this year).

(c) The services of a family member in painting the

family home. Excluded. - Not a market transaction. If any

payment is made, it will be within the family.

(d) The income of a dentist. Included. -

Payment for a final service. You cannot pass on a tooth

extraction!

(e) The money received by Smith when she sells her

economics textbook to a book buyer. Excluded. - Secondhand

sales are not counted; the textbook is counted only when sold for the

first time.

(f) The monthly allowance a college student

receives from home. Excluded. - A private transfer payment;

simply a transfer of income from one private individual to another

for which no transaction in the market occurs.

(g) Rent received on a two-bedroom apartment.

Included. - Payment for the final service of housing.

(h) The money received by Josh when he resells his

current-year-model Honda automobile to Kim. Excluded. - The

production of the car had already been counted at the time of the

initial sale.

(i) The publication of a college textbook.

Included. - It is a new good produced for final

consumption.

(j) A 2-hour decrease in the length of the

workweek. Excluded. - The effect of the decline will be

counted, but the change in the workweek itself is not the production

of a final good or service or a payment for work done.

(k) The purchase of an AT&T corporate bond.

Excluded. - A noninvestment transaction; it is merely the

transfer of ownership of financial assets. (If AT&T uses the

money from the sale of a new bond to carry out an investment in real

physical assets that will be counted.)

(l) A $2 billion increase in business inventories.

Included. - The increase in inventories could only occur as a

result of increased production.

(m) The purchase of 100 shares of GM common stock.

Excluded. - Merely the transfer of ownership of existing

financial assets.

(n) The purchase of an

insurance policy. Included. - Insurance is a final service. If

bought by a household, it will be shown as consumption; if bought by

a business, as investment—as a cost added to its real investment

in physical capital.