|

Unit 1: ECONOMICS and

GLOBALIZATION

- 1a

- Introduction to the Course

- 1b

- What is Economics and the 5Es

- 1c

- Making Choices: Production Possibilities (PPC) and

Benefit-Cost Analysis (BCA)

- 2a

- Economic Systems and Globalization

- 2b

- Role of Government and Government Finance

- 3a

- Demand

- 3b

- Supply

- 3c

- Market Equilibrium and Efficiency

- 20a

-Why we Trade: Comparative Advantage

- 20b

- International Trade and Foreign Exchange

Markets

Unit 2: INTRO. TO

MACROECONOMICS

Unit 3: MACROECONOMIC

POLICY

Unit 1: ECONOMICS and GLOBALIZATION

|

Unit 2: INTRO. TO MACROECONOMICS |

Unit 3: MACROECONOMIC POLICY |

Unit 1: Economics and

Globalization

Lesson 1a: The Class and the

Math

Welcome to ECO 212!

1a Introduction

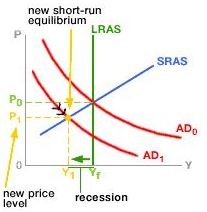

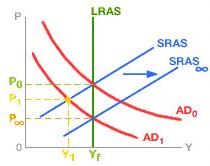

This course will cover the area of economics commonly defined as macroeconomics. The main goal of macroeconomics is to gain a better understanding of the causes of, and remedies for, UNEMPLOYMENT (UE) and INFLATION (IN), as well as the factors that affect ECONOMIC GROWTH (EG). We will also discuss the two types of economic growth, what I like to call "ACHIEVING THE POTENTIAL" and "INCREASING THE POTENTIAL".

Please buy the textbook as soon as possible. If you buy your textbook online, order it today. See the syllabus for the correct textbook. The textbook should cost less than $30 if you buy it online.

While you wait for your textbook to arrive there is still some work that you can do.

To begin, I suggest you do the following:

- read the syllabus

- check out our Blackboard site. Click on the menu links and see what is there

- take the Syllabus Quiz (see link on Blackboard)

- you may also begin some of the chapter 1 assignments,+ see: LESSONS

+ especially the online reading: The 5Es of Economics

Email me or use the Blackboard Discussion Board if you have questions.

Many students end up dropping or failing this course due to the lack of basic math skills. If your math skills are weak you should consider building them before taking this course. If you are required to take MTH 060 or MTH 082 and have not yet done so, do not take this economics course until you have successfully completed one of them.

I have posted a math quiz on our Blackboard site. Take the math quiz on Blackboard. If you score less then 14 or 15, consider dropping ECO 212 and taking a math class first.

Good luck and start studying.

Optional: a funny look at some major ideas of economics by

the Stand-up Economist.

1a Something Interesting - Why are we

studying this?

Principles

of economics, translated

https://www.youtube.com/watch?v=VVp8UGjECt4

*NOTE: There will be a short case study for most lessons ("Something Interesting - Why are we studying this?"). The case study does not include everything from the lesson but it will highlight an interesting and important topic. The case studies are meant to grab your attention and help you APPLY a concept from the lesson to a real world issue. At first the case study may not make sense. In fact, many will appear contrary to common sense, (like why are high prices GOOD for the people suffering from a natural disaster), but after finishing the lesson you should have a better understanding of the case study or ask for help in class or on the Blackboard discussion board.

Read: Syllabus

1a Assignments: Readings

20th: Ch. 1, pp. 4-8, (19th: pp. 3-7) "The Economic Perspective", "Theories Principles and Models", "Microeconomics and Macroeconomics",

Ch.1, Appendix on Graphing

WHAT IS ECONOMICS: THE STUDY OF SCARCITY

1a Assignments: Video

Lectures

- 1.1.1 Scarcity - Defining Economics 6:35 [MyNotes]

- 1.1.2 What Economists Do 13:20 [MyNotes]

- 1.1.3 Macroeconomics and Microeconomics 11:21 [MyNotes]

- EconMovies- Episode 1: Star Wars (Scarcity, Choices, and Exchange)

REVIEW OF GRAPHING CONCEPTS

- 1.2.1 Using Graphs to Understand Direct Relationships 9:50 [MyNotes]

- 1.2.2 Plotting A Linear Relationship Between Two Variables 9:57 [MyNotes]

- 1.2.3 Changing the Intercept of a Linear Function 8:42 [MyNotes]

- 1.2.4 Understanding the Slope of a Linear Function 7:28 [MyNotes]

OPTIONAL:

- Khan Academy Exercise: Graphing Points

- Khan Academy Exercise: Graphing Points 2

TOPICS

1a Outcomes - What you should

learn

- Introduction to the course

- What is Economics?

- Basic math and graphing

- Math Quiz

OUTCOMES

- Basic math skills

- How to find class information

- Explain and illustrate a direct relationship between two variables, and define and identify a positive sloping curve. (Appendix)

- Explain and illustrate an inverse relationship between two variables, and define and identify a negative slope. (Appendix)

- Be able to calculate the slope of a line.

- Define economics and describe the four

components of the definition:

- social science

- choice

- scarcity

- maximizing satisfaction

- What are economic models and why do economists use them?

- Explain the importance of ceteris paribus in formulating economic principles.

- Differentiate between microeconomics and macroeconomics.

- Define and give examples of the four types of resources (factors of production) and know the payment for each

Key

Terms Flash Cards - Class Activities - Click Here

1a Key Terms

Key Terms Flash Cards - What is Economics? - Click Here

Key Terms Flash Cards - Math - Click Here

Key Terms:

CLASS ACTIVITIES: Pre-quiz, Clicker Quiz, Required Activity, Yellow Pages, Tomlinson Videos on Thinkwell, Video Notes, LESSONS webpage,WHAT IS ECONOMICS?: economics, economic model, microeconomics, macroeconomics, utility, rational choice, opportunity cost, benefit-cost analysis (marginal analysis), ceteris paribus (other things equal assumption),

MATH: direct (positive) relationship, inverse (negative) relationship, slope of a line, positive slope, negative slope, origin, horizontal (x) axis, vertical (y) axis

Slope = rise/run

1a Key Formulas

Slope = vertical change / horizontal change

Slope = marginal value of the total

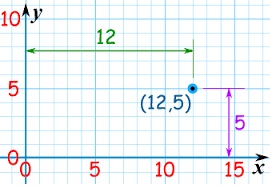

Any Point on a Graph Represents Two Numbers

1a Key Graphs

Direct Relationship

Inverse Relationship

Calculating Slope

Episode

5A: Models & Theories

1a Review Videos

[3:26 YouTube mjmfoodie]

Episode

6: Graph Review

[4:22 YouTube mjmfoodie]

NOTE: These are REVIEW videos only. In order to learn the material you must read the assigned textbook readings, watch the assigned lecture videos, and do problems. See the MACWEBAPP or the LESSONS link for these assignments.

Unit 1: Economics and

Globalization

Lesson 1b: How to Reduce Scarcity -

Introduction to Economics and the 5Es

The "5Es of Economics" are not from the textbook. I borrowed the

concept (with many modifications) from another textbook many years

ago. I believe it concisely explains the purpose of economics. Also,

it begins to introduce students to the economic way of thinking. The

economic problem that we all face, that all countries face, that the

world faces, is SCARCITY. Economics is the study of how we can reduce

scarcity. What I like about the 5Es model is that it shows us that

there are only five ways to reduce scarcity. Only five. I call them

the "5Es" of economics.

1b Introduction

For each of the 5Es:

(1) learn the definition,

(2) understand examples, and

(3) most importantly, know how they reduce scarcity and help to increase society's satisfaction.

This is where you learn that it may be good when the price of plywood increases greatly as the result of a hurricane. And why it might be good when Coca-Cola lays of one fifth of its workforce. Or, that the price of gasoline may be too low. Really!

In this MACROeconomics course we will focus on Economic Growth and Full Employment. Efficiency, efficiency, and equity are the focus of my MICROeconomics classes and few economists study "Reducing Wants". The overall goal of economics is to REDUCE the SCARCITY of goods and services. Economic growth and full employment are two (of five) ways to do this.

Pay close attention to the new definition of economic growth presented in the online reading. It is different from what you might hear in a news report. Also, pay attention to HOW such economic growth is achieved:

- finding more resources,

- getting better resources,

- and inventing better technology.

This type of economic growth involves INCREASING THE POTENTIAL of the economy to produce goods and services.

Full employment helps an economy ACHIEVE ITS POTENTIAL by using all of its resources. Again, notice the slightly different definition than is commonly used for full employment. We are not just talking about labor, but ALL available resources.

There are three issues that macroeconomics studies: (1) unemployment - UE, (2) inflation - IN, and (3) economic growth - EG, (UE, IN, and EG).

When a hurricane hits the coast of Florida, prices of many

necessities like food, water, hotel rooms, gasoline, and even

plywood, tend to increase. Some governments try to prevent such price

increases and call them "price-gouging".

1b Something Interesting - Why are we

studying this?*

See: http://www.csmonitor.com/1992/0910/10083.html

But economists think that such price increases are GOOD for the people ravaged by the hurricane. WHY? Why is it GOOD when the prices of products (like plywood) increase during a natural disaster?

See: https://www.masterresource.org/price-gouging-law/defense-price-gouging/

ANSWER: Allocative Efficiency

*NOTE: There will be a short case study for each lesson. The case study does not include everything from the lesson but it will highlight an interesting and important topic. The case studies are meant to grab your attention and help you APPLY a concept from the lesson to a real world issue. At first the case study may not make sense. In fact, many will appear contrary to common sense, (like why are high prices GOOD for the people suffering from a natural disaster), but after finishing the lesson you should have a better understanding of the case study or ask for help in class or on the Blackboard discussion board.

Syllabus

1b Assignments: Readings

The 5Es of Economics (VERY IMPORTANT!)

Ch. 3, pp. 64-65 (19th, 58-59) "Efficient Allocation"

Ch. 3, p. 55 (19th, 49) "Diminishing Marginal Utility"

Ch.1, Appendix on Graphing

Macroeconomics

Unit 1 Intro: Basic Economic Concepts (AP

Macro) (YouTube ACDCLeadership 1:38)

[MyNotes]

1b Assignments: Video

Lectures

Scarcity and Exchange - EconMovies #1: Star Wars (YouTube ACDCLeadership 6:39)

TOPICS

1b Outcomes - What you should

learn

- Introduction to economics and scarcity

- The 5Es of Economics and how they increase society's satisfaction

- "Economic Growth": achieving the potential vs increasing the potential

OUTCOMES

- What is the "invisible hand" of capitalism?

- What is "SCARCITY" as it is defined in

economics?

(What two things cause the scarcity of goods and services? - What is "erskinite"? Is erskinite scarce?

- What is the goal of economics?

- What are society's three options for dealing with scarcity?

- What do the 5Es do?

- For each of the 5Es:

- Define

- Explain how it affects society's satisfaction

- Give an example

- The 5Es:

- ECONOMIC GROWTH

- ALLOCATIVE EFFICIENCY

- PRODUCTIVE EFFICIENCY

- EQUITY

- FULL EMPLOYMENT

- How does economic growth differ from the other Es?

- What are the three ways to achieve economic growth?

- Economic Growth, what is the difference between "Achieving the Potential" and "Increasing the Potential"?

- What are the three ways to achieve productive efficiency?

- What is the President Obama example? Explain how it can be used to show that equity can increase society's satisfaction. Why did we use such a strange example?

- What is the law of diminishing marginal utility? What does "marginal" mean?

- Why it is GOOD for the people of Florida if, after a hurricane strikes, the price of plywood (or other products) increases from $10 a sheet to $30 a sheet

- Why it was GOOD when the Coca-Cola company (or other companies) lays off 6000 workers as they did in the year 2000.

- Why the price of gasoline in the United States is TOO LOW (We may have to wait until after we finish chapter 5 to truly understand this.)

- How does our new definition of full employment differ from what you will hear on the news?

Key

Terms Flash Cards - Click Here

1b Key Terms

Key Terms:

scarcity, economic growth, allocative efficiency, productive efficiency, equity, full employment, marginal, law of diminishing marginal utility, President Trump example

How

EQUITY Increases Society's Satisfaction

1b Key Problems

Since it is difficult for us to agree on a definition of "fairness", let me see if I can come up with an extreme example on which we can all agree. What if President Trump owned everything? I mean EVERYTHING - all the land, all the buildings, all the food, all the clothes all the cars, -- everything in the country. Therefore, the rest of us own nothing. We are homeless, starving, and naked. Not a pretty picture, but can we all agree that this is not fair (not equitable)?

Now, let's say that President Trump gives us each a pair of pants. We should be able to agree that this is more fair, more equitable, right? So what happens to society's satisfaction? By "society" I mean all of us including President Trump. We who received the pants are more satisfied since each of us has a pair of pants, but President Trump is less satisfied because he has 300 million fewer pairs of pants.

So what happens to society's (us and Trump) TOTAL satisfaction? It depends on HOW MUCH happier we are and HOW MUCH less happy President Trump is. This brings us to the Law of Diminishing Marginal Utility (you may wan to look this up in the index of your textbook).

Utility is the reason we consume a goods or services. You might call it the satisfaction that we get when we consume something. I get satisfaction (utility) when I drive my boat. I get utility (satisfaction?) when I go to the dentist.

"Marginal" means EXTRA or ADDITIONAL. so if I drive my boat a second time I get some additional (marginal) utility.

According to the law of diminishing marginal utility the EXTRA (not the total) utility diminishes for each additional unit consumed. The first time I drive my boat in the spring I really enjoy it. But after a few weekends of boating it doesn't give me as much additional satisfaction as the first time. I still go boating. My total utility still goes up. But the MARGINAL (extra) utility I get from one more day goes down.

Back to the President Trump Example. Since we start with no pants, the first pair we get from President Trump gives us A LOT of utility (satisfaction). But, since President Trump still has millions (or billions) of pairs of pants left, giving us 300 million causes his utility (satisfaction) to go down only A LITTLE. OVERALL the society's utility (all of us including President Trump ) increases. From the same amount of resources we (include Trump) are receiving more satisfaction.

The 5Es of Economics

1b Key Figures / Graphs

1b Review

Quiz

What

Is Economics?

1b Review Videos

[2:45 YouTube jodieecongirl]

NOTE: These are REVIEW videos only. In order to learn the material you must read the assigned textbook readings, watch the assigned lecture videos, and do problems. See the MACWEBAPP or the LESSONS link for these assignments.

Unit 1: Economics and

Globalization

Lesson 1c: Making Choices: Production

Possibilities Curve (PPC) and Benefit Cost

Analysis

In the 5Es lesson we learned that economics is about making choices.

Choices are forced upon us as a result of scarcity. Here we will

study a graphical model, the Production Possibilities Curve (PPC)

that shows us that we MUST MAKE choices and it highlights some of the

consequences of making choices. Then we will look at HOW to make good

choices by using Benefit Cost Analysis (BCA).

1c Introduction

The production possibilities curve will show us that all decisions have costs. Economists call these "opportunity costs". ALL COSTS IN ECONOMICS ARE OPPORTUNITY COSTS. Whenever we discuss the "costs" of doing something we will mean the complete opportunity cost.

What is the connection between the PPC and BCA? Well, when studying the PPC you will learn the important concept of "opportunity cost". Learn the definition well. Since all costs in economics are opportunity costs, then when using BCA, "marginal costs" means the additional opportunity costs.

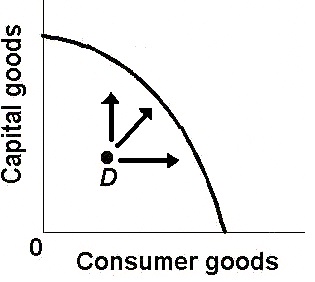

Also, since economic growth is one of the three macroeconomic issues. We will use the PPC to demonstrate the two types of "economic growth":

- an economy ACHIEVING ITS POTENTIAL

- and an economy INCREASING ITS POTENTIAL

Achieving the potential is caused by reducing unemployment or achieving productive efficiency. On the graph it is moving from a point inside the PPC to a point on the SAME CURVE. Increasing the potential, or what we will call economic growth, is shown on the PPC as the whole curve shifting out to a NEW CURVE. We will see this again in chapter 8.

Why would airbags in cars cause more accidents (see the link below)?

After studying this lesson you should be able to use Benefit Cost

Analysis (MB=MC) to answer this question.

1c Something Interesting - Why are we

studying this?

Drivers with airbags may take more risks

A similar question for skiers is why did the invention of avalanche airbags cause more people to become caught in avalanches (see below)? After studying this lesson you should be able to use Benefit Cost Analysis (MB=MC) to answer this question.

In a March 2013 blog post written by Utah Avalanche Center Director Bruce Tremper . . . Tremper says airbags are providing a false sense of security, leading more skiers into high-consequence terrain, and thus decreasing the effectiveness of said airbag."Each gizmo we buy to increase our safety usually cause us to increase our level of risk at the same time. For instance, when we added seat belts and airbags to cars, yes fatalities decreased, but it also allowed us to drive faster, farther, crazier and talk on our mobile phones at the same time. So safety measures usually work but not nearly as well as we would hope because people just increase their risk (and “utility”) at the same time. In avalanche airbag case, we will also get more powder, more fun, and more risk in the bargain . . . . people will increase their exposure to risk because of the perception of increased safety, which will cancel out some, but not all, of the effectiveness of avalanche airbag"What are avalanche airbags?

https://www.youtube.com/watch?v=h7QFRXc0R8M

Ch 1, pp. 11-20 (19th,10-21), "Society's Economizing Problem",

"Production Possibilities Model"

1c Assignments: Readings

Ch. 1, pp. 6-7 (19th p. 5), "Marginal Analysis: Comparing Benefits and Costs"

Ch. 1, pp. 14-15 (19th,13-14), "Optimal Allocation" (especially Fig 1.3),

Drivers with airbags may take more risks

Ch 1, p. 15 (19th, 14), "Consider This . . . The Economics of War"

PRODUCTION POSSIBILITIES

1c Assignments: Video

Lectures

1.4.1 Understanding the Concept of Production Possibilities Frontiers 24:46 [MyNotes]1.4.2 Understanding How a Change in Technology Affects the PPF 10:10 [MyNotes]

MAKING CHOICES: THE ECONOMIC WAY OF THINKING -- BENEFIT-COST ANALYSIS (also called Marginal Analysis or Cost-Benefit Analysis)

EconMovies- Episode 2: Monty Python and the Holy Grail - Marginal Analysis (YouTube ACDCLeadership 5:27)Thinking at the Margin (YouTube LearnLiberty 4:32) [MyNotes]

Incentives and Marginal Analysis (YouTube MrHurdleHistory 8:54) [MyNotes]

OTHER

Micro 1.1 The BIG Picture- AP Economics Overview (with links to playlists) (YouTube ACDCLeadership 12:49)ECONMOVIES Episode 3: Monsters Inc. and the Production Possibilities Curve

KEY PROBLEM

Using Benefit Cost Analysis (BCA)

http://www.harpercollege.edu/mhealy/eco211f/videos/1bprobbca.mp4

TOPICS

1c Outcomes - What you should

learn

- PPC (Production Possibilities Curve)

- BCA (Benefit Cost Analysis or Marginal Analysis)

OUTCOMES

Production Possibilities

- Construct a production possibilities curve (PPC) when given appropriate data; what is the production possibilities curve (PPC) or production possibilities frontier (PPF)?; what does it show?

- What are the assumptions behind the PPC

- Illustrate the following using the

production possibilities curve:

- we must make choices

- choices have opportunity costs

- the law of increasing costs

- the effect of unemployment

- the effect of productive inefficiency

- how present choices affect future possibilities

- the effect of international trade

- two types of "economic growth"

- it does NOT show the optimum product mix (allocative efficiency)

- Explain WHY the PPC has the shape that it does -- concave to the origin. What is the law of increasing cost?

- Why are there increasing costs? Why is the PPC concave to the origin? (Draw, Define. Describe all graphs)

- What would the PPC look like if there were constant costs?

- What does a point outside the PPC represent?

- What two things (2 Es) would a point inside the PPC indicate?

- Give some real-world applications of the production possibilities concept.

- Summarize the general relationship between investment and economic growth.

- What is the difference between "achieving the potential" and "increasing the potential"? Show the difference on a PPC. What are the two types of "economic growth" and how are they shown on a PPC?

- What would cause a PPC to shift inward?

- Use a PPC to illustrate the effect of international trade

- Be able to draw and explain the Circular Flow Model

Benefit Cost Analysis

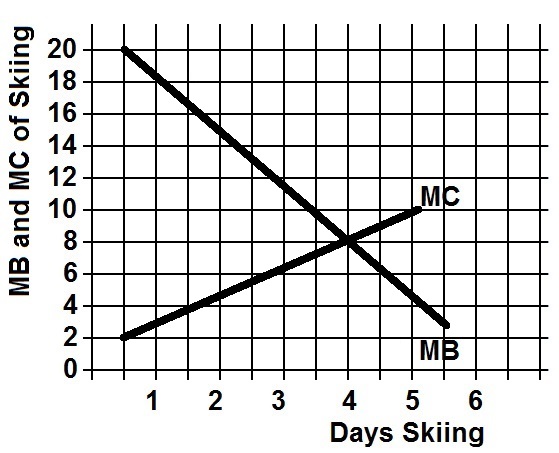

- define benefit cost analysis (BCA) and use it to solve problems

- define "marginal" and give examples

- define marginal benefits (MB) and marginal costs (MC)

- explain why we ignore fixed, or sunk, costs ("Don't cry over spilt milk.")

- know what happens if MC increase? decrease?

- know what happens if MB increase? decrease?

- draw MB and MC on a graph and explain their shapes

- be able to find the optimum choice from a table of total costs and total benefits and from a table of marginal costs and marginal benefits

- use BCA to explain why Drivers with airbags may take more risks or why skiers with air bags may take more risks

- what is a "sunk cost" (or fixed cost) and why are they ignored when using benefit-cost analysis?

- "Don't cry over spilt milk " If you are deciding whether or not to come to class today, why does it not matter that you have already paid tuition? Why is the fact that you have paid tuition irrelevant when trying to decide whether to attend class today or skip?

Key

Terms Flash Cards - Click Here

1c Key Terms

Key Terms:

PPC:production possibilities, necessity of choice, law of increasing costs, concave to the origin, opportunity cost, constant cost, benefit cost analysis (marginal analysis), economic growth, consumer goods, capital goods, shrinking PPC, nonproportional growth

BCA:

marginal costs (MC), marginal benefits (MB), MB=MC Rule, sunk (fixed) costs

1c Key Problems

Production Possibilities Curve (PPC) - Click Here

Using Benefit Cost Analysis (BCA) - Click Here

Click here to see PPC questions

Using Benefit Cost Analysis (BCA) Question:

Use the above information on four different

highway programs of increasing scope to decide which program the

government should do.

All numbers are in billions of dollars.

Use Benefit Cost Analysis to answer the question.

MB = MC

1c Key Formulas

MB = change in Total Benefits / change in Quantity

MB = ![]() TB

/

TB

/ ![]() Q

Q

MC = change in Total Costs / change in Quantity

MC = ![]() TC

/

TC

/ ![]() Q

Q

Notice that I will use a triangle (![]() )

to mean "change in"

)

to mean "change in"

Production Possibilities Schedule and Curve

1c Key Graphs

PPC: Achieving Full Employment and Achieving

Productive Efficiency

(Achieving the Potential)

PPC: Economic Growth (Increasing the Potential)

Benefit Cost Analysis

1c Review

Quiz

- Production

Possibilities Curve- Econ 1.1

1c Review Videos

[3:56 YouTube ACDC Leadership]

- Shifting

the Production Possibilities Curve (PPC)- Econ

1.2

[5:35 YouTube ACDC Leadership]

NOTE: These are REVIEW videos only. In order to learn the material you must read the assigned textbook readings, watch the assigned lecture videos, and do problems. See the MACWEBAPP or the LESSONS link for these assignments.

Unit 1: Economics and

Globalization

Lesson 2a: Economic Systems and

Globalization

Because of scarcity we must make choices. An "economic system" is

the way that societies make economic choices. Because of scarcity all

countries must decide (1) what to produce, (2) how to produce, and

(3) who get what is being produced. Economic systems answer these

fundamental questions.

2a Introduction

All over the world economies are undergoing a process that I like to call "structural adjustment", but it is more commonly called "globalization". That is, countries are moving away from a command economy with government central planning to a laissez-faire market economy or capitalism. In this process the economic role of government is decreasing all over the world (well, almost).

In order to understand why this is happening we have to study unit 1, chapters 1, 2, 3 and 20, which are really MICROeconomic chapters. Strangely our Tomlinson videos do not discuss in depth the characteristics of market economies but our textbook does (chapter 2). Our textbook does not spend much time discussing command economies (planned economies), or economies in transition from planned to market (from command to capitalism), but the video lectures do!

When studying chapter 2, both the textbook and the videos, try to understand the following: (1) What are the characteristics of market and command economies? (2) What are their benefits and problems? and, (3) Why are countries moving away from a command economy toward a market economy?

In lesson 2a we will examine those questions. Then, in lesson 2b, we will look at what the role of government should play in a market economy. All over the world the economic role of government is decreasing, but it is not disappearing. So, what IS the economic role of government in market economies?

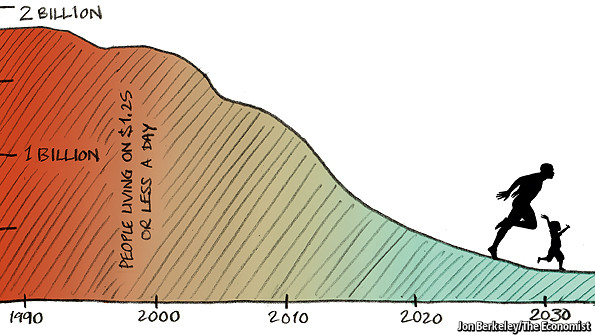

Structural adjustment, or globalization, has helped take nearly 1

billion people out of extreme poverty in 20 years. How? Read the

short article below.

2a Something Interesting - Why are we

studying this?

http://www.economist.com/news/leaders/21578665-nearly-1-billion-people-have-been-taken-out-extreme-poverty-20-years-world-should-aim/

In the fifth paragraph the article says:

"Most of the credit [for poverty reduction in the last twenty years] must go to capitalism and free trade, for they enable economies to grow - and it was growth principally that eased destitution."

We will take a look at the country of Venezuela which has the world's largest oil reserves and was once the richest country in South America. But now Venezuela has severe food and gasoline shortages and the world's highest inflation rate at over 15,000%. "[B]asic goods such as coffee, sugar, rice, milk, pasta, toilet paper, hand soap, and detergent remain impossible to find". Hospitals are without medicine, food is rationed, and people are fleeing the country. What happened? In the last two decades in order to help the poor, the government took control of the economy, nationalizing industries and controlling prices. And the economy has collapsed.

Online

2a Assignments: Readings

- A Comparison of Command Economies and Market Economies- Globalization and Structural Adjustment: http://www.economist.com/news/leaders/21578665-nearly-1-billion-people-have-been-taken-out-extreme-poverty-20-years-world-should-aim/

- Venezuela and Government Control of Economy: https://foreignpolicy.com/2016/06/19/venezuela-maduro-food-shortages-price-controls-political-unrest/

- OPTIONAL - Cuba Examines Asian Model For Economic Reforms (NPR Morning Edition)

Textbook:

Chapter 2 ALL (19th Ch. 2 ALL)Ch. 2, p. 47, (19th, 42), "Last Word: Shuffling the Deck"

Ch. 8, p. 186 (19th, 164), "Global Competition"

Chapter 23W of the 16th edition of our textbook, pages 2-13, found on our Blackboard site

- State Ownership and Central Planning: pp. 23W-2 to 23W-3

- Problems with Central Planning pp. 23W-3 to 23W-5

- The Collapse of the Soviet Economy pp. 23W-5 to 23W-6

- The Russian Transition to a Market System pp. 23W-6 to 23W-9

- Market Reforms in China pp. 23W-10 to 23W-11

- Outcome and Prospects pp. 23W-11 to 23W-13

- Conclusion pp. 23W-13

ECONOMIC SYSTEMS

2a Assignments: Video

Lectures

10.1.2 The Circular Flow Model 9:38 [MyNotes]1.1.4 An Overview of Economic Systems 10:50 [MyNotes]

Power of the Market (YouTube LibertyPen) 1:14 [MyNotes]

1.1.5 Case Study: The Work of Adam Smith 8:57 [MyNotes]

TRANSITION ECONOMIES

17.5.1 Centrally Planned Economies 10:57 [MyNotes]17.5.2 Policies to Change to Market Systems 11:18 [MyNotes]

17.5.3 Comparative Economic Performance 12:16 [MyNotes]

OPTIONAL (but interesting) Paul Solman Video: Capitalism vs. Socialism - The Cuban Quandary (YouTube PBS NewsHour) 13:56

GLOBALIZATION

Why Venezuela is in crisis CNN Money 1:49OPTIONAL: Economic Systems and Macroeconomics: Crash Course Economics #3 [10:18]

OPTIONAL: Globalization and Trade and Poverty: Crash Course Economics #16 [9:01]

TOPICS

2a Outcomes - What you should

learn

- Economic Systems

- Market Economies

- Command Economies

- Mixed Economies

- Structural Adjustment (Globalization)

- Characteristics of a Market Economy (Capitalism)

- Economics Systems and the 5Es

- Circular Flow Model

OUTCOMES

- What is "structural adjustment" and what are its policies and problems?

- Highlight the main features of a market economy and a command economy.

- List and explain the important characteristics of the American market system.

- Explain how a market system achieves

economic efficiency and why command economies do not.

- Describe how prices drive the movement of resources in a market system.

- The important role of profits and losses in a market economy

- Explain the role of self-interest and "invisible hand" in promoting economic efficiency.

- Explain why the command systems of the Soviet Union, Eastern Europe, and China failed.

- The coordination problem and incentive problem of command econmies

- What is the role of money in a market economy?

- "Between 1990 and 2010, the percent of people living in poverty fell by half as a share of the total population in developing countries, from 43% to 21%—a reduction of almost 1 billion people." WHY? What was the one main "poverty reduction measure" that contributed to this success? Explain.

- Understand some of the basic economic causes of the collapse (?) of the Venezuelan economy

- The circular flow model

Key

Terms Flash Cards - Click Here

2a Key Terms

Key Terms:

structural adjustment, economic system, command system (centrally planned, socialism, command economy), market system (captialism, laissez-faire, market economy), mixed economic system, Bolshevik revolution, self interest, private property, freedom of enterprise and choice, competition, market, specialization, consumer sovereignty, dollar votes, invisible hand, creative destruction, coordination problem, incentive problem, circular flow diagram, product market, resource market, privatization, nationalization, central planning, shock therapy, import substitution

2a Key Graphs

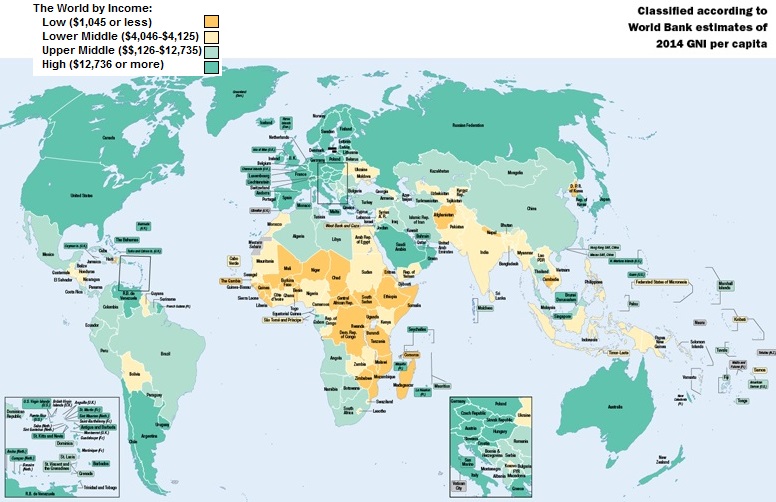

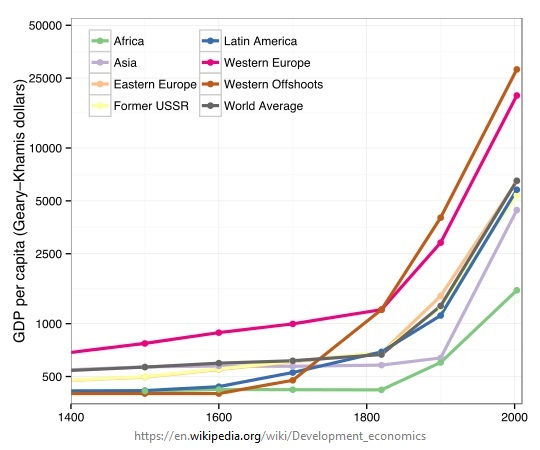

World Decrease in Poverty - mostly caused by Structural Adjustment

Circular Flow Model

2a Review Quizzes: Capitalism

/ Command

Economies

- Econ

1.6- Economic Systems: Why is Communist China doing so

well?

2a Review Videos

[4:13 YouTube ACDC Leadership]

NOTE: These are REVIEW videos only. In order to learn the material you must read the assigned textbook readings, watch the assigned lecture videos, and do problems. See the MACWEBAPP or the LESSONS link for these assignments.

Unit 1: Economics and

Globalization

Lesson 2b: The Economic Role of

Government and Government Finance

Now, you should have a good idea of the characteristics, benefits,

and problems of the two main types of economic systems and understand

how, and why, countries seem to be moving toward a market, or more

laissez-faire, system. Here we will examine the economic functions of

government in a market economy.

2b Introduction

Most economists, and politicians, agree on these general principles, BUT they may disagree strongly on the degree of involvement the government should have in the economy. I think, most people agree on WHAT the government should do, but they disagree on HOW MUCH.

We learned in lesson 2a that market economies are efficient and that centrally (government) planned command economies are inefficient. So whenever there is government involvement in a market economy we should ask WHY? If market economies are efficient and efficiency reduces scarcity, why would the government get involved? We will learn that sometimes the government is needed to ASSIST a market economy to be efficient and sometimes a market economy is inefficient and the government is needed to FIX it.

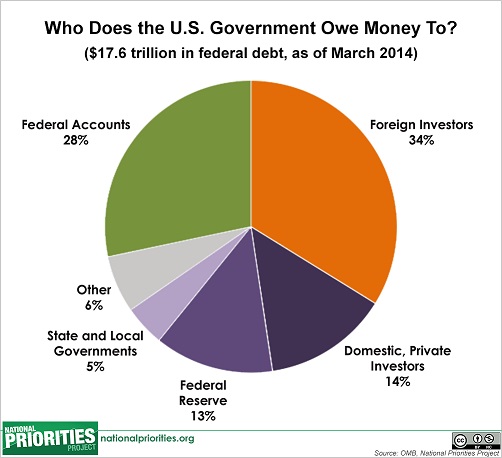

After looking at the economic functions of government we will look at government finance in the United States. Latter in this course we will discuss how the goverment uses spending and taxation to affect the economy. Here we learn what the government spends its money on and where governments get their revenue (taxes).

Skim the news articles below about raising taxes on gasoline and

putting taxes on soda and junk food. After studying this lesson you

should understand why many people support these taxes.

2b Something Interesting - Why are we

studying this?

Why might

gasoline prices be too low?

http://www.npr.org/templates/story/story.php?storyId=4858826

Why are several cities and states considering a tax on sodas?

http://www.stltoday.com/news/local/illinois/buying-soft-drinks-in-illinois-would-cost-more-under-tax/article_5eccc299-6c48-5b44-9643-95bce5365dee.htmlhttp://www.sfgate.com/bayarea/article/Tax-on-soda-to-be-floated-in-San-Francisco-4932025.php

Why did Mexico tax junk food and soda?

http://www.politico.com/story/2014/01/mexico-soda-tax-101645

Economic

Functions of Goverment

2b Assignments: Readings

Ch. 4, pp. 90-94, 96-100, (19th, 99-102, 104-108) "Public Goods", "Externalities"

Microeconomics Chapter 16 (found on our Blackboard site): pp 338-346

- Government Finance;

- Federal Finance;

- State and Local Finance;

- Local, State, and Federal Employment;

- Apportioning the Tax Burden;

- The VAT

Tax Brackets (Marginal Tax Rates) (audio or reading only)

Role

of Government in a Mixed Economy

(YouTube - Daniel Mares15:53) [MyNotes]

2b Assignments: Video

Lectures

When is a Potato Chip Not Just a Potato Chip (YouTube-LearnLiberty 4:46)

Public Goods and Asteroid Protection (MRUniversity 2:30)

EconMovies 7: Anchorman (Efficiency and Market Failures)

A Deeper Look at Public Goods (MRUniversity 7:55)

Where do your tax dollars go? (YouTube - Test Tube News 3:44)

8.2.2 Analyzing the Tax System (8:19) [MyNotes]

OPTIONAL: Tax Brackets and Progressive Taxation Khan Academy (4:14)

TOPICS

2b Outcomes - What you should

learn

- Economic Functions of Government in an Market Economy

- Government Finance:

- Expenditures and Revenues

- Average and Marginal Tax Rates

- Progressive, Proportional, and Regressive taxes

OUTCOMES

- Functions of Government

- Understand the five functions of government in a market economy

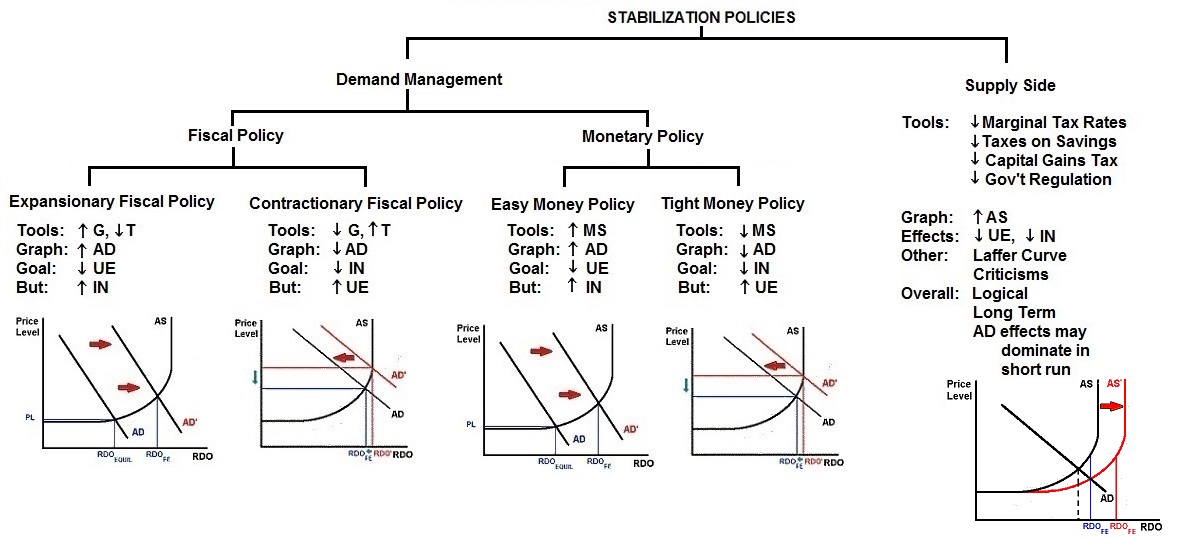

- stabilization policies: what should the government do if unemployment is high? if inflation is high?

- Negative Externality:

- too much produced without government, why?

- government micht tax or regulate to reduce consumption

- Positve Externality:

- Too little produced without government, why?

- government might subsidize or produce the product itself to increase production

- Public good

- nonexcludable and nonrival

- NONE produced without government

- government must produce

- Why are public schools, public parks, and public libraries NOT "public goods"?

- Government Finance

- What are the major revenue sources and major expenditures for the federal, state, and local governments?

- Define and give examples of progressive, proportional, and regressive taxes.

- Be able to calculate average tax rates, marginal tax rates, and taxes paid

- Calculate average tax rates and marginal tax rates.

- What are the PROS and CONS of using a lottery to finance government?

- Discuss the progressivity or

regressivity of the following taxes:

- federal income tax

- sales tax

- payroll tax (Social Security Tax)

- property tax

- exhaustive and non exhaustive government

purchases

or government purchases vs. government spending, - benefits received principle, vs. ability-to-pay principle (sometimes called the equal sacrifice principle) and the law of diminishing marginal utility

Key

Terms Flash Cards - Role of Government - Click Here

2b Key Terms

Key Terms Flash Cards - Government Finance - Click Here

Key Terms:

Role of Government:consumer sovereignty, monopoly, natural monopoly, antitrust, transfer payments, market intervention, market failure, negative externality, positive externality, public goods, private goods, rivalry, nonrival, excludability, nonexcludability, free-rider problem, macroeconomic stability, fiscal policy, monetary policy, expansionary fiscal policy, easy money policy, contractionary fiscal policy, tight money policy,Government Finance:

government purchases, exhaustive, transfer payment, nonexhaustive, deficit spending, personal income tax, payroll tax, benefits received principle, ability-to-pay principle, average tax rates, marginal tax rates, progressive tax, proportional tax, regressive tax, value added tax (VAT)

Calculate

tax owed, marginal tax rate, and average tax rate

2b Key Problems

If Taxable Income is Between:

The Tax Due is:

Given the Tax Rate Schedule above, calculate the following:

If taxable income is

$9,325: The amount of tax owed:

__________________ The marginal tax rate:

__________________ The average tax rate:

__________________ If taxable income is

$10,325: The amount of tax owed:

__________________ The marginal tax rate:

__________________ The average tax rate:

__________________

2b Key Formulas

Average Tax Rate = taxes paid / income

Marginal Tax Rate = change in taxes paid / change in income

Marginal Tax Rate = ![]() taxes /

taxes / ![]() income

income

Notice that I will use a triangle (![]() )

to signify "change in"

)

to signify "change in"

2b Review Quizzes: Market

Failures / Gov't

Finance

Micro

Unit 6 Intro- Market Failures and the Government

2b Review Videos

[2:31 YouTube ACDC Leadership]

NOTE: These are REVIEW videos only. In order to learn the material you must read the assigned textbook readings, watch the assigned lecture videos, and do problems. See the MACWEBAPP or the LESSONS link for these assignments.

Unit 1: Economics and

Globalization

Lesson 3a: Demand

If the price of pizza goes up, what happens to the demand for pizza?

. . . . . . . . . . . . . . . . .

. . . . . . . . . . . . .

3a Introduction

The next three lessons introduce the demand and supply model for explaining how prices arise and change in a market economy. Learn these lessons well. Do the assigned problems. Draw the graphs in the Yellow Pages and while you are reading and studying. DRAW GRAPHS! Get used to using the graphs to help you answer questions. If you are avoiding drawing the graphs you will do poorly and not get the practice that you need to learn the concept.

So why doesn't the demand for pizza change if the price changes? Because economists have a different definition of "demand". Demand is NOT the quantity that we buy. If the price of pizza goes up we will buy less, but that is not what "demand" means in economics.

Economists tend to be precise with their definitions and sometimes their definitions are different than the more commonly used definitions. Things like "scarcity", "investment", "cost", "demand", and "supply", have different definitions in economics than what you may already know. Learn our definitions! Demand is not how much we buy. Demand has a different definition in economics. "Demand" means the "demand graph".

Economists use models (like the supply and demand model) to simplify the real world. They do this by isolating certain variables from all the clutter found in reality. Then by changing one variable at a time economists can see what effect it will have.

In this lesson we will learn the economic definition of DEMAND and plot the demand graph. Then, we will look at one variable at a time to see what effect they have on the demand curve. We call these variables the "non-price determinants of demand". They are: Pe, Pog, I, Npot, T or "PPINT". LEARN THEM! LEARN THEM WELL! Know how each one affects the demand curve. Be sure to do the Yellow Pages and other Practice Activities until you understand the concept well.

See the picture below. VanCamp's Pork and Beans are on sale (price

is lower). Notice that there is a can of Campbell's Pork and Beans on

the sale display.

3a Something Interesting - Why are we

studying this?

What is that Campbell's Pork and Beans can doing on the display for VanCamp's Pork and Beans?

After studying this lesson you will be able to draw a graph illustrating what happened to the demand for Campbell's Pork and Beans when a customer took a can out of their shopping cart and placed it on this display of VanCamp's beans that were on sale.

Ch 3, pp. 53-59, (19th 47-53) "Demand"

3a Assignments: Readings

2.1.1 Understanding

the Determinants of Demand 11:58

[MyNotes]

3a Assignments: Video

Lectures

2.1.2 Understanding the Basics of Demand 11:54 [MyNotes]

2.1.3 Analyzing Shifts in the Demand Curve 8:13 [MyNotes]

2.1.4 Changing Other Demand Variables 10:43 [MyNotes]

2.1.5 Deriving a Market Demand Curve 9:16 [MyNotes]

OPTIONAL:

The Law of Demand (econclassroom.com 11:24)Changes in Demand versus Changes in Quantity Demanded (econclassroom.com 5:52)

The Determinants of Demand (econclassroom.com 11:07)

TOPICS

3a Outcomes - What you should

learn

- Demand:

- Define

- Draw

- Describe

- Determinants

OUTCOMES

- define demand (note: it has a DIFFERENT DEFINITION in economics)

- If the price of pizza goes up, why does the demand for pizza stay the same?

- be able to correctly draw and label a demand graph

- why do economists employ the ceteris paribus assumption when creating a demand curve?

- what is the law of demand?

- why is the demand curve downward sloping (three explanations)

- list the non-price determinants of demand (Pe. Pog, I, Npot, T) and understand how they affect the demand schedule and curve. This is VERY IMPORTANT. BE ABLE TO DO THIS! See the 3a/3b/3c yellow pages.

- explain the difference between the a "change in the quantity demanded" and a "change in demand"

- what is an increase in demand and a decrease in demand and show how they affect the demand schedule and the demand curve

- what is "market demand"?

- what is that Campbell's Pork and Beans can doing on the display for VanCamp's Pork and Beans (see picture at left)? Which non-price determinant of demand explains why that Campbell's soup can is there?

3a Non-Price Determinants of Demand and Supply |

Pe -- expected price

Pog -- price of other goods1) substitute goods

2) complementary goods

3) independent goodsI -- income

1) normal goods

2) inferior goodsN -- number of POTENTIAL consumers

T -- tastes and preferences

Non-Price Determinants of Supply (PPPTTN)

Pe -- expected price

Pog -- price of other goods produced by same firm

Pres -- price of resources

T --technology

T --taxes and subsidies

N -- number of producers/sellers

NON-PRICE DETERMINANTS OF DEMAND

Pe -- expected price

Pe in the future

D today

Pe in the future

D today

Pog -- price of other goods

1) substitute goods

P Maxwell House coffee

D Folgers coffee

P of one product

D of its substitute

2) complementary goods

P of wieners

D of buns

P of one product

D of its compliment

I -- income

1) normal goods

Income

D for normal goods

Income

D for normal goods

2) inferior goods

Income

D for inferior goods

Income

D for inferior goods

Npot -- number of POTENTIAL consumers

Npot

D

Npot

D

T -- tastes and preferences

Tastes for a product

D for that product

Tastes for a product

D for that product

NON-PRICE DETERMINANTS OF SUPPLY

Pe -- expected price

Pe in the future

S today

Pe in the future

S today

Pog -- price of other goods also produced by the same firm

P soybeans

S corn

P soybeans

S corn

Pres -- price of resources

worker's wages

cost of making cars

S cars

Pres

costs

S

Pres

costs

S

Tech --technology

Improved technology

costs

S

Tax --taxes and subsidies

Taxes

costs

S

Taxes

costs

S

Subsidies

costs

S

Subsidies

costs

S

N -- number of producers/sellers

Nproducers

S

Nproducers

S

Key

Terms Flash Cards - Click Here

3a Key Terms

Key Terms:

demand, quantity demanded, law of demand, market demand, horizontal summation, income effect, substituion effect, diminishing marginal utility, change in demand, change in quantity demanded, increase in demand, decrease in demand, non-price determinants of demand, normal good, inferior good, substitute good, complementary good (complement), independent goods

Demand Schedule and Curve

3a Key Graphs

Change in Quantity Demanded

Change in Demand: Increase

Change in Demand: Decrease

Market Demand

- Demand

and Supply Explained- Econ 2.1

3a Review Videos

[6:20 YouTube ACDC Leadership]

NOTE: These are REVIEW videos only. In order to learn the material you must read the assigned textbook readings, watch the assigned lecture videos, and do problems. See the MACWEBAPP or the LESSONS link for these assignments. .

Unit 1: Economics and

Globalization

Lesson 3b: Supply

If the price of pizza goes up what happens to the SUPPLY of pizza?

NOTHING!

3b Introduction

A change in the price of a product does not affect its supply, or its demand. When the price goes up the QUANTITY SUPPLIED will increase, but the supply does not change. Learn the difference between "supply" and "quantity supplied". "Supply" does NOT MEAN the quantity available for sale. Supply has a different definition in economics. "Supply" means the "Supply graph".

So what would cause the supply graph, or supply itself, to change? Those things that cause supply to change are called the "non-price determinants of supply". They are: Pe, Pog, Pres, Tech, Tax, Nprod or "PPPTTN". See the Yellow Pages.

Remember, the goal of chapter 3 is to learn a model that will help us understand why prices are what they are and why they change. In the next lesson we will put demand and supply together and use the model (graph) to find the prices of products. Then, and more importantly, we will see what causes prices to change.

After completing this chapter, if you hear on the news, or read in your news app, that the price of gasoline is going down, we will be able to explain WHY. The causes of changes in prices of products are the five non-price determinants of demand (Pe, Pog, I, Npot, T) and/or the six non-price determinants of supply (Pe, Pog, Pres, Tech, Tax, Nprod.). Whenever you hear that the price of something is changing think of these 11 possible causes.

Read the short news article below on the declining price of gasoline

(Dec. 2015). Paragraph 10 states "Plunging oil prices are the main

factor driving down the price at the pump. "

3b Something Interesting - Why are we

studying this?

After studying this lesson you should be able to (1) list the non-price determinants of supply, (2) select the determinant that is the cause of the decline in gasoline prices discussed in the news article above, and (3) graph the effect that the change in the determinant will have on the supply curve for gasoline.

Ch. 3, pp. 59-62, (19th, 53-56) "Supply"

3b Assignments: Readings

Where

Is All That Excess Oil Going?

[Why are they storing oil? What is happening to supply? Which

determinant has caused the supply to change?]

Read this online lecture: Demand and Supply

2.2.1 Understanding

the Determinants of Supply 7:25

[MyNotes]

3b Assignments: Video

Lectures

2.2.2 Deriving a Supply Curve 9:49 [MyNotes]

2.2.3 Understanding a Change in Supply versus a Change in Quantity Supplied 6:52 [MyNotes]

2.2.4 Analyzing Changes in Other Supply Variables 8:47 [MyNotes]

2.2.5 Deriving a Market Supply Curve from Individual Supply Curves 7:16 [MyNotes]

OPTIONAL

AC Econ 2.2 Demand and Supply Explained (2 of 2) (4:54 but just watch up to 2:45)EP AP Macro-Economics - Determinants of Supply [YouTube - ExamPop]

KA Factors affecting supply (6:57) NOTE : It looks like the supply graph is labelled "D", but that is just point D (A, B, C, D) on the supply curve.

TOPICS

3b Outcomes - What you should

learn

- Supply

- Define

- Draw

- Describe

- Determinants

OUTCOMES

- define supply (note: it has a DIFFERENT DEFINITION in economics)

- be able to correctly draw and label a supply graph

- if the price of pizza goes up why does the supply not change?

- why do economists employ the ceteris paribus assumption when creating a supply curve?

- what is the law of supply?

- why is the supply curve upward sloping (two explanations)

- list the non-price determinants of supply (Pe, Pog, Pres, Tech, Taxes, Nprod) and understand how they affect the supply schedule and curve. This is VERY IMPORTANT. BE ABLE TO DO THIS! See the 3a/3b/3c yellow pages.

- explain the difference between the a "change in the quantity supplied" and a "change in supply"

- what is an increase in supply and a decrease in supply and show how they affect the supply schedule and the supply curve

- what is "market supply"?

- Read the following and answer these

questions:

- Which determinant has changed?

- Will it affect S or D of gasoline?

- Will the S or D of gasoline increase or

decrease? Shift to the right or to the left?

"According to the Lundberg Survey, the average price for regular gasoline dropped 3.99 cents over the three weeks up to July 11 to $3.6699 per gallon. . . . Lundberg explained that the average gasoline price continues to decrease because refiners, enjoying the lower crude oil prices in the market, are passing down the savings to the consumers. "

3b Non-Price Determinants of Demand and Supply |

Pe -- expected price

Pog -- price of other goods1) substitute goods

2) complementary goods

3) independent goodsI -- income

1) normal goods

2) inferior goodsN -- number of POTENTIAL consumers

T -- tastes and preferences

Non-Price Determinants of Supply (PPPTTN)

Pe -- expected price

Pog -- price of other goods produced by same firm

Pres -- price of resources

T --technology

T --taxes and subsidies

N -- number of producers/sellers

NON-PRICE DETERMINANTS OF DEMAND

Pe -- expected price

Pe in the future

D today

Pe in the future

D today

Pog -- price of other goods

1) substitute goods

P Maxwell House coffee

D Folgers coffee

P of one product

D of its substitute

2) complementary goods

P of wieners

D of buns

P of one product

D of its compliment

I -- income

1) normal goods

Income

D for normal goods

Income

D for normal goods

2) inferior goods

Income

D for inferior goods

Income

D for inferior goods

Npot -- number of POTENTIAL consumers

Npot

D

Npot

D

T -- tastes and preferences

Tastes for a product

D for that product

Tastes for a product

D for that product

NON-PRICE DETERMINANTS OF SUPPLY

Pe -- expected price

Pe in the future

S today

Pe in the future

S today

Pog -- price of other goods also produced by the same firm

P soybeans

S corn

P soybeans

S corn

Pres -- price of resources

worker's wages

cost of making cars

S cars

Pres

costs

S

Pres

costs

S

Tech --technology

Improved technology

costs

S

Tax --taxes and subsidies

Taxes

costs

S

Taxes

costs

S

Subsidies

costs

S

Subsidies

costs

S

N -- number of producers/sellers

Nproducers

S

Nproducers

S

Key

Terms Flash Cards - Click Here

3b Key Terms

Key Terms:

supply, quantity supplied, market supply, horizontal summation, law of supply, change in supply, change in quantity supplied, increase in supply, decrease in supply, non-price determinants of supply

Supply Table and Curve

3b Key Graphs

Increase in Supply

Decrease in Supply

- Demand

and Supply Explained (2 of 2) - Econ 2.2

3b Review Videos

[4:54 YouTube ACDC Leadership]

NOTE: These are REVIEW videos only. In order to learn the material you must read the assigned textbook readings, watch the assigned lecture videos, and do problems. See the MACWEBAPP or the LESSONS link for these assignments.

Unit 1: Economics and

Globalization

Lesson 3c: Market Equilibrium

and Efficiency - So, what happens to Price and

Quantity?

We are going to learn two very important things in this

lesson.

3c Introduction

First, we will put demand and supply together and learn how to use the model to to see why products have the prices that they do. Then, and more importantly, we will see what causes prices to change.

If you hear on the news or read in your news app, that the price of gasoline is going down, we will be able to explain WHY. The causes of changes in prices of products are the five non-price determinants of demand (Pe, Pog, I, Npot, T) and/or the six non-price determinants of supply (Pe, Pog, Pres, Tech, Tax, Nprod.). Whenever you hear that the price of something is changing think of which of these 11 possible causes have changed, draw the graph and shift the appropriate demand and/or supply graph, and the graph will show the price changing.

Second, after we learn that in a competitive market economy the interaction of demand and supply will determine what the prices of products will be and how much people will buy at that price, we will ask: Is this the allocatively efficient quantity and price? Our goal is to show that in a competitive market the price will change until allocative efficiency is achieved. In chapter 2 we learned that markets are allocatively efficient. This means they will produce the quantity of goods that maximizes the society's satisfaction. After studying chapter 3 we will bew able to show the allocatively efficient price and quantity on a graph.

Competitive markets are efficient.

Read the first few paragraphs of Hybrid

Car Prices Increasing Due To High Gas Prices.

3c Something Interesting - Why are we

studying this?

In lesson 3a you learned how the non-price determinants of demand (Pe, Pog, I, N, T) affect the demand curve. In lesson 3b you learned how the non-price determinants of supply (Pe, Pog, Pres, Tech, Tax, Nprod) affect the supply curve.

After studying this lesson you will be able to use these determinants and graphs to explain why prices change. For example you will understand why: "It's becoming almost an annual tradition: As fuel prices rise in the spring, so do the prices of hybrid cars. "

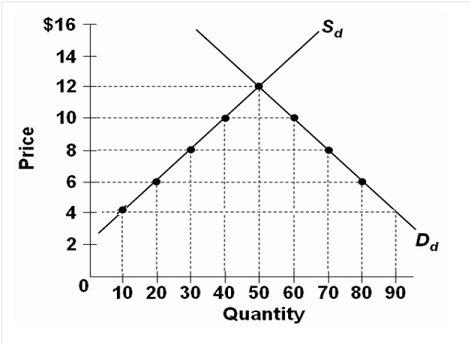

Ch. 3, pp. 62-70, 75-80, (19th, 56-64, 69-74), "Market Equilibrium",

"Additional Examples of Supply and Demand"

3c Assignments: Readings

Ch. 4, pp. 85- 90, (19th, 93-99), "Efficiently Functioning Markets"

Supply, Demand, and Economic Efficiency

PUTTING SUPPLY AND DEMAND TOGETHER

3c Assignments: Video

Lectures

2.3.1 Determining a Competitive Equilibrium 11:04 [MyNotes]2.3.2 Defining Comparative Statics 7:02 [MyNotes]

2.3.3 Classifying Comparative Statics 11:54 [MyNotes]

AC Micro 2.4 Double Shifts in Supply and Demand: Econ Concepts in 60 Seconds (2:34)

EconMovies: Episode 4: Indiana Jones (Demand, Supply, Equilibrium, Shifts) (7:02)

MARKETS AND EFFICIENCY

Efficiency and Equilibrium in Competitive Markets (econclassroom.com 11:48) [begin at 7:27 and stop at 8:44, we will not cover consumer and producer surplus] [MyNotes]

TOPICS

3c Outcomes - What you should

learn

- Market Equilibrium

- Market Equilibrium and Changes in D and S

- Market Equilibrium and Allocative Efficiency

- Price Ceilings, Price Floors, and Allocative Efficiency

OUTCOMES

Market Equilibrium

- Explain the concept of equilibrium price and quantity.; define equilibrium; find the equilibrium price and quantity on a supply and demand schedule and graph

- Illustrate graphically equilibrium price and quantity.

- what happens if the price is below the equilibrium price? If it is above it?

- define "shortage" and "surplus" and explain using a supply and demand graph

- the four steps to finding a new equilibrium when a non-price determinant changes and how to use them (see the yellow pages)

- what happens to the equilibrium price and quantity if (1) demand increases, (2) demand decreases, (3) supply increases, and (4) supply decreases.

- Explain and graph the effects of simultaneous changes in demand and supply on equilibrium price and quantity

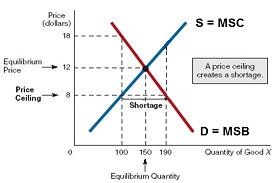

- Price ceilings, price floors, and allocative efficiency

Markets and Efficiency

- define marginal social benefit and explain why it is often measured by the demand curve

- define marginal social cost and explain why it is often measured by the supply curve

- explain why allocative inefficiency occurs where MSB > MSC causing an underallocation of resources; show on graph using the MSB=MSC model

- explain why allocative inefficiency occurs where MSB < MSC causing an overallocation of resources; show on graph using the MSB=MSC model

- Explain how equilibrium achieves allocative efficiency.

- be able to find WHAT WE GET and WHAT WE WANT the MSB=MSC model graph

3c Non-Price Determinants of Demand and Supply |

Pe -- expected price

Pog -- price of other goods1) substitute goods

2) complementary goods

3) independent goodsI -- income

1) normal goods

2) inferior goodsN -- number of POTENTIAL consumers

T -- tastes and preferences

Non-Price Determinants of Supply (PPPTTN)

Pe -- expected price

Pog -- price of other goods produced by same firm

Pres -- price of resources

T --technology

T --taxes and subsidies

N -- number of producers/sellers

NON-PRICE DETERMINANTS OF DEMAND

Pe -- expected price

Pe in the future

D today

Pe in the future

D today

Pog -- price of other goods

1) substitute goods

P Maxwell House coffee

D Folgers coffee

P of one product

D of its substitute

2) complementary goods

P of wieners

D of buns

P of one product

D of its compliment

I -- income

1) normal goods

Income

D for normal goods

Income

D for normal goods

2) inferior goods

Income

D for inferior goods

Income

D for inferior goods

Npot -- number of POTENTIAL consumers

Npot

D

Npot

D

T -- tastes and preferences

Tastes for a product

D for that product

Tastes for a product

D for that product

NON-PRICE DETERMINANTS OF SUPPLY

Pe -- expected price

Pe in the future

S today

Pe in the future

S today

Pog -- price of other goods also produced by the same firm

P soybeans

S corn

P soybeans

S corn

Pres -- price of resources

worker's wages

cost of making cars

S cars

Pres

costs

S

Pres

costs

S

Tech --technology

Improved technology

costs

S

Tax --taxes and subsidies

Taxes

costs

S

Taxes

costs

S

Subsidies

costs

S

Subsidies

costs

S

N -- number of producers/sellers

Nproducers

S

Nproducers

S

Key

Terms Flash Cards - Click Here

3c Key Terms

Key Terms:

equilibrium, market equilibrium, bidding mechanism, surplus, shortage, scalping, productive efficiency, allocative efficiency, marginal social benefits, marginal social costs, "what we get", "what we want", profit maximizing quantity, underallocation of resources, overallocation of resources, price ceiling, price floor

3c Key Problems

Click on the links above to learn how to use a supply and demand graph to show why prices and quantities change. The exam 1 extra credit question will be similar to these problems.

Use the four-step process to explain what happens to PRICE (P) and QUANTITY (Q) of the following goods using the information provided in the short news articles below.

Four Step Process1. Which determinant has changed?

2. Will it affect Supply (S) or Demand (D)?

3. Will S or D increase or decrease?

4. GRAPH IT and show what happens to P and Q.Non--Price Determinants of Demand (PPINT)

Pe -- expected price

Pog -- price of other goods (subs and Complw)

I - income (normal and inferior goods)

N -- number of POTENTIAL consumers

T -- tastes and preferencesNon-Price Determinants of Supply (PPPTTN)

Pe -- expected price

Pog -- price of other goods PRODUCED. BY THE SAME FIRM

Pres -- price of resources

T - technology of production

T -- taxes and subsidies

N -- number of sellersProduct: Beef. What happens to P and Q? Circle and label determinants. Show effects on a graph.

http://www.bloomberg.com/news/articles/2014-11-18/us-beef-supply-will-fall-again-in-2015-chicken-demand-will-riseDomestic beef production has been waning [decreasing] for years because of rising feed and energy prices. A drought in 2012 caused feed prices to spike and, in response, farmers thinned their herds.Product: Chicken. What happens to P and Q? Circle and label determinants. Show effects on a graph.

http://www.bloomberg.com/news/articles/2014-11-18/us-beef-supply-will-fall-again-in-2015-chicken-demand-will-riseIt's been an expensive year to eat beef, and 2015 doesn't look any cheaper. . . . Consumers have traded down to less expensive meats such as chicken.Product: Almonds. What happens to P and Q? Circle and label determinants. Show effects on a graph.

http://www.cnbc.com/2016/08/29/california-almond-harvest-may-break-records-despite-drought.htmlWith the drought easing in parts of California, this year's almond harvest is shaping up to be a record haul …. Consumers have already taken an interest in almond products because of their "heart health" benefits.Product: McDonald's meals. What happens to P and Q? Circle and label determinants. Show effects on a graph.

http://www.bloomberg.com/news/articles/2014-10-20/mcdonald-s-costly-burgers-send-diners-to-fancier-rivalsMike Hiner used to take his grandsons to McDonald's when they wanted a treat. With higher wage and food costs pushing up prices at the Golden Arches, he's increasingly taking them to IHOP, Denny's and Chili's instead . . . . The chain's diminishing appeal among budget diners -- coupled with rising meat costs -- are projected to take a bite out of third-quarter earnings due to be reported tomorrow.

.

Market Equilibrium

3c Key Graphs

Changes in Demand And Supply

Price Ceiling

Price Floor

3c Review

Quiz - Lessons 3a, 3b, and 3c

- Shifting

Demand and Supply- Econ 2.3

3c Review Videos

[4:49 YouTube ACDC Leadership]

- Double

Shifts- Econ 2.5 (Technical Tuesday)

[3:26 YouTube ACDC Leadership]

- Price

Ceilings and Floors- Economics 2.6

[4:34 YouTube ACDC Leadership]

NOTE: These are REVIEW videos only. In order to learn the material you must read the assigned textbook readings, watch the assigned lecture videos, and do problems. See the MACWEBAPP or the LESSONS link for these assignments.

Unit 1: Economics and

Globalization

Lesson 20a: Why we Trade: Comparative

Advantage

In Lesson 2a we learned about the following Structural Adjustment

Policies and the following characteristics of capitalist

economies:

20a Introduction

Structural Adjustment Policies:

- Privatization

- Promotion of Competition

- Reduced Role of Government

- Removing Price Controls

- FREER TRADE and Convertible Currency

- Foreign Investment

Characteristics of Capitalist

Economies:

- private property

- freedom of enterprise and choice

- role of self interest

- competition -

- markets and prices

- limited role for government

In this lesson we will study trade.Trade increases competition and helps the world's economies achieve PRODUCTIVE EFFICIENCY (producing at a minimum cost by using resources where they are best suited). Therefore it is an important concept to study in any introductory economics course.

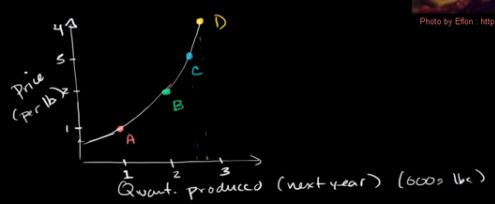

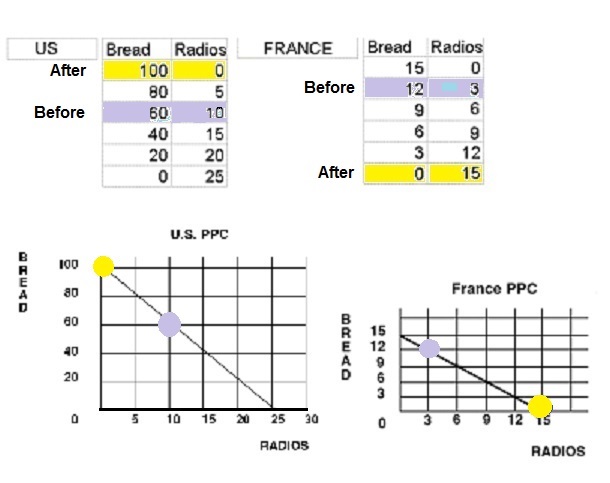

We will learn that trade based on COMPARATIVE ADVANTAGE can help the world PRODUCE MORE from the same amount of resources. Trade allows all countries to consume beyond their production possibilities (point E on the graph below).

How is that possible?

We will also learn that even if a country is better at producing all products, it is still possible for it to come out ahead if it specializes and trades with other (less productive) countries.

How is that possible?

That is why there has been a trend over several decades of the world moving to ward freer and freer trade.

Read the first four paragraphs of The

Mystical Power of Free Trade.

20a Something Interesting - Why are

we studying this?

After studying this lesson you should understand:

- why "society benefits from allowing its citizens to buy what they wish--even from foreigners." (i.e. the gains from trade),- and why "people resist this conclusion, sometimes violently"

Ch. 20, pp. 442-452 (19th, 398-407), "Some Key Trade Facts", "The

Economic Basis for Trade", "Comparative Advantage"

20a Assignments: Readings

"The Mystical Power of Free

Trade"

http://www.cnn.com/ALLPOLITICS/time/1999/12/06/free.trade.html

VERY USEFUL: Lecture Outline

1.5.1 Defining

Comparative Advantage with the Production Possibilities

Frontier 22:10 [MyNotes]

20a Assignments: Video

Lectures

1.5.2 Understanding Why Specialization Increases Total Output 6:46 [MyNotes]

1.5.3 Analyzing International Trade Using Comparative Advantage 25:35 [MyNotes]

1.5.4 Outsourcing 8:54 [MyNotes]

17.4.3 Hot Topic: Winners and Losers in NAFTA 4:20 [MyNotes]

KEY PROBLEM: The gains from trade

OPTIONAL

KA Comparative advantage specialization and gains from trade (8:55)EC Determining Comparative Advantage using PPCs – Worked solutions to AP Free Response Questions (8:27)

TOPICS

20a Outcomes - What you should

learn

- Why do we trade?

- Absolute Advantage, Comparative Advantage, and the Gains from Trade

- Terms of Trade

OUTCOMES

- why do the gains from trade appear to be hidden from many people?

- what is the economic basis for specialization and exchange (trade)?

- calculate the opportunity costs using straight line production possibilities

- define and find absolute advantage and comparative advantage using straight line (constant costs) production possibilities

- calculate how specialization and trade increases output using the production possibilities tables or graphs of two different countries (i.e. calculate the gains from trade)

- compute the minimum and maximum terms of trade

Key

Terms Flash Cards - Click Here

20a Key Terms

Key Terms:

opportunity cost, constant costs, increasing costs, absolute advantage, comparative advantage, gains from trade, free trade, terms of trade, minimum and maximum terms of trade

20a Key Problems

The Gains from Trade - Click Here

Click on the link above to learn how to do this problem.

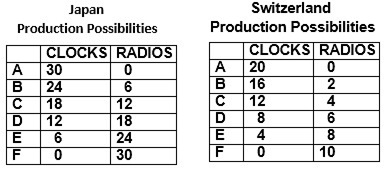

Assume that prior to specialization and trade, Japan produced at point D and Switzerland produced at point E. Calculate the possible gains from specialization and trade.

Comparative Advantage and the Gains from Trade

20a Key Graphs

20a Review

Quiz

- Comparative

advantage specialization and gains from trade | Microeconomics | Khan

Academy

20a Review Videos

[8:55 YouTube Khan Academy]

NOTE: These are REVIEW videos only. In order to learn the material you must read the assigned textbook readings, watch the assigned lecture videos, and do problems. See the MACWEBAPP or the LESSONS link for these assignments.

Unit 1: Economics and

Globalization

Lesson 20b: International Trade and

Foreign Exchange Markets

Everything discussed in Lesson 20a about trade (specialization and

exchange) can be applied to trade between individuals, cities,

counties, states, and countries. In this lesson we will focus

specifically on INTERNATIONAL trade (trade between countries).

20b Introduction

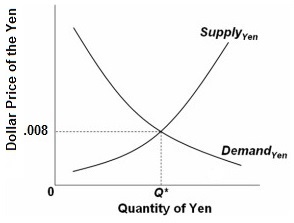

Comparative advantage still applies, but there are some differences between INTERnational trade (trade between countries) and INTRAnational trade (trade within a country). These differences include greater distances, politics, and the use of different currencies.

Lesson 20b begins with a review of the FACTS of international trade (see: Lecture Outline). Then we will look at what happens when politicians restrict trade (and therefore cause inefficiency). And we will finish up with learning how to use a supply and demand graph to understand why exchange rates change.

Concerning exchange rates: students often believe that a strong dollar is good and a weak dollar is bad. This is not always true. If the U.S. dollar appreciates (increases in value) it is often called a "strong dollar". What a strong dollar does is make it cheaper for Americans to buy foreign imports (or make it cheaper to take a ski trip in Canada). A strong dollar also makes it more expensive for foreigners to purchase U.S. exports. Therefore, a strong dollar may be good for consumers because of cheap imports, but bad for workers because of less exports, fewer jobs, and more unemployment).

The link below goes to a LIST of articles on the international

trade agreements, including the Trans Pacific Partnership (TPP),

found on the Huffington Post news site. President Trump took the US

out of the TPP soon after he became president. The Huffington Post

tends to be a more liberal news site, that is less supportive of free

trade. Scroll down just looking at the titles of the news

articles over the last few months. You will see that many of them

appear to oppose the free trade agreements.

20b Something Interesting - Why are

we studying this?

Trans

Pacific Partnership

http://www.huffingtonpost.com/news/trans-pacific-partnership/

After studying this lesson you will have a better understanding of why many people oppose such trade agreements BUT most economists say that such agreements benefit the US economy and the world economy.

Ch. 20, pp. 443-465 (19th, 398-418), "Some Key Trade Facts", "Trade

Barriers and Export Subsidies", "The Case for Protection",

"Multilateral Trade Agreements and Free-Trade Zones"

20b Assignments: Readings

Ch. 20, p. 464 (19th, 419), "The Last Word - Petition of the Candlemakers, 1845"

Ch. 21, 475-78 (19th, 429-432), "Flexible Exchange Rates"

Ch. 21, 484-488 (19th, 438-439) "Recent U.S. Trade Deficits"

Trans-Pacific Partnership

- http://www.nytimes.com/2015/05/12/business/unpacking-the-trans-pacific-partnership-trade-deal.html

VERY USEFUL: Lecture Outline

17.4.2 Trade

Policy 7:17 [MyNotes]

20b Assignments: Video

Lectures

17.1.1 Determining the Difference between a Closed Economy and an Open Economy 8:55 [MyNotes]

Why do Countries Restrict Trade? (8:34) [MyNotes]

Types of Trade Restrictions (9:43) [MyNotes]

17.1.2 Understanding Exports in an Open Economy 5:22 [MyNotes]

17.3.1 Nominal Exchange Rates 11:32 [MyNotes]

17.3.4 Determination of Exchange Rates 12:31 [MyNotes]

17.3.5 Floating and Fixed Systems 13:18 [MyNotes]

TOPICS

20b Outcomes - What you should

learn

- Facts About Trade

- Trade Restrictions

- Exchange Rates

- Trade Deficits

OUTCOMES

- summarize the importance of international trade to the U.S. in terms of overall volume and major trading partners.

- list the major imports and exports of the United States and identify the major its major trading partners

- identify types of trade barriers

- describe the economic impact of tariffs, including both direct and indirect effects.

- contrast the economic impact of a quota with that of a tariff.

- list six arguments in favor of protectionist barriers, and critically evaluate each

- who gains from trade restrictions? who loses?

- the two most popular arguments against free trade are (1) we need to restrict trade to crease more jobs here, and (2) how can our workers compete against workers who are paid only a few dollars a day? Why do these two argments make NO ECONOMIC SENSE?

- why are import quotas more restrictive than tarriffs?

- identify the costs of protectionist policies and their effects on income distribution.

- understand the benefits and problems of a "strong dollar" and a "weak dollar"

- what causes exchange rates to appreciate and depreciate?

- understand the causes and effects of trade deficits

Key

Terms Flash Cards - Click Here

20b Key Terms

Key Terms:

imports, exports, trade barriers, tariff, revenue tariff, protective tariff, import quota, nontariff barrier, export subsidies, special interest effect, infant industry, dumping, WTO, NAFTA, TPP, offshoring, exchange rate, strong dollar, weak dollar, appreciation, depreciation, trade deficit, trade surplus

Using

Demand and Supply Graphs to Show Why Exchange Rates

Change

20b Key Problems

When Americans buy foreign products or make financial investments overseas we demand foreign currency and supply dollars

When foreigners buy American products or make financial investments in the U.S. they demand dollars and supply their currency

DETERMINANTS: Why would Americans demand foreign currency and supply dollars?

To buy more foreign products: PPINT